Digital mortgage technology is a solution for lending organizations that want to optimize loan processing workflows, thus enabling them to make data-backed decisions accurately and quickly. This approach pairs software APIs, artificial intelligence and in-depth mortgage underwriting expertise into a software package. This helps to optimize how underwriting teams handle risk assessment and complex mortgage scenarios.

Automated Income Analysis

Blueprint provides IncomeXpert PLUS for digital mortgage lending applications by leveraging AI to automate data entry and income analysis tasks. Our digital mortgage technology in IncomeXpert PLUS employs sophisticated algorithms and advanced OCR and auditing software to accurately determine a borrower’s qualifying income.

Integration with LOS

As originations continue to increase, lenders seek a digital mortgage lending solution that can impactfully communicate with these LOS platforms to secure critical information in one centralized location. Blueprint offers native and custom API integrations to automate workflows across the loan life cycle for virtually any LOS or POS.

Full Reps and Warrants

Automation for digital mortgage technology can’t overlook reps and warrants. Our digital mortgage lending solutions provide full reps and warrants on our work. Blueprint provides industry leading rep and warrant coverage on not only the calculations, but also on the guideline compliance and data entry for the analysis.

BluePrint By the Numbers

Founded in 2013

We Solve Income Errors Two Different Ways

IncomeXpert

IncomeXpert is a complete income analysis solution for brokerages, credit unions, community banks, and national lenders.

With IncomeXpert, users get assurance of no guideline or calculation errors. Your users enter data into IncomeXpert manually following our easy to follow income worksheets, prompts, and pop ups. This is a cost effective option for many teams.

- NO guideline errors

- NO calculation errors

- Manual data entry

IncomeXpert PLUS

IncomeXpert PLUS layers on additional error reduction and convenience by using artificial intelligence on OCR to perform data entry.

Upload tax returns, paystubs, and VOEs and our software scans the uploaded documents, identifies what is present and identifies missing tax forms, enters the data into the loan file, and determines the recommended income automatically.

- NO guideline errors

- NO calculation errors

- NO data entry errors

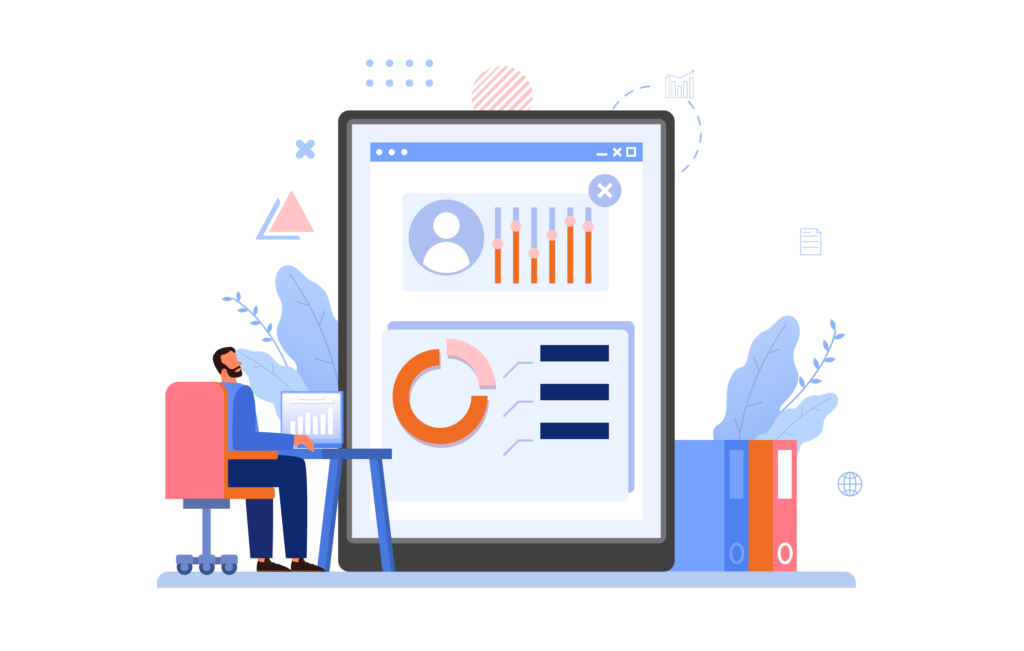

How Digital Lending Helps Lenders

Reducing Manual Errors

Unlike manual mortgage processing approaches, which are prone to human error and inconsistent data interpretation, our digital mortgage technology drastically reduces a financial organization’s exposure to compliance violations by leveraging various error-prevention validation, cross-referencing, and compliance monitoring mechanisms. It also incorporates advanced algorithms to identify guideline compliance issues and inconsistent income information.

Streamlining Underwriting Workflows

Our digital mortgage technology leverages innovative automation to assess income calculation risks, income trending analysis, and compliance checks. This approach speeds up underwriting review processes to facilitate better decision-making.

Ready to request a demo with BluePrint today?

Built for Workflows

Unlike other solutions, IncomeXpert is designed with your workflow in mind. Our software understands the roles of each user and the current stage of the loan lifecycle, dynamically adjusting permissions. This ensures that sales teams can use IncomeXpert with limited controls to determine a safe income, while underwriters have the flexibility to adjust for higher income when necessary.

Advisories To Stay Ahead of Guidelines

IncomeXpert includes over 200 income advisories that alert underwriters if additional guidelines apply. With IncomeXpert, you stay compliant with the latest agency guidelines to ensure calculated income is correct.

Full Reps & Warrants

We stand behind our calculations with Reps and Warrants on the calculations, guideline compliance, and data entry. If our calculations are erroneous or non-compliant, we will make it right.

Human guided Automation

We enhance your underwriting team’s efficiency with smart human guided automation, without compromising the essential expertise of your underwriters. Our tools streamline guideline memorization, data entry, and calculation analysis, freeing your underwriters to focus on critical risk assessment and decision-making.

Why Choose Blueprint for Digital Mortgage Lending?

Accurate OCR-Powered Income Analysis

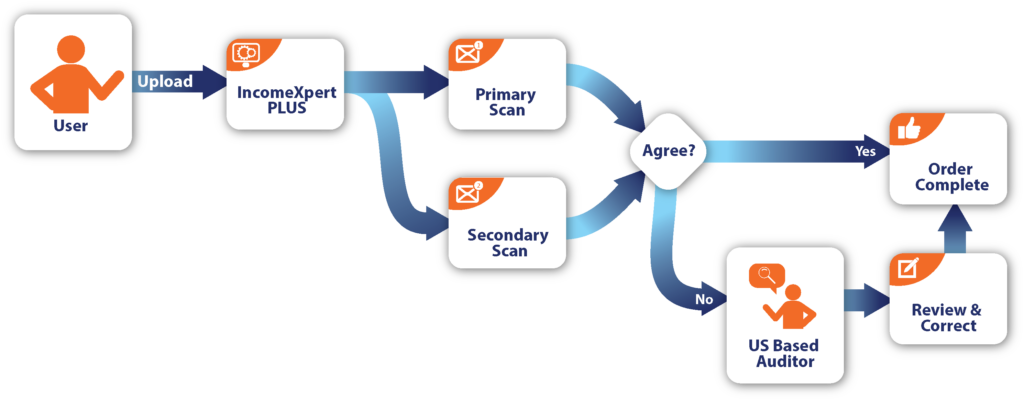

Our advanced digital mortgage lending system powers your digital transformation using highly accurate OCR technology. Blueprint leverages OCR differently than others. We created two independent OCR scanning systems backed by a human in the loop to reconcile differences. This allows Blueprint to offer best in industry rep and warrant coverage, and more confidence to our clients.

Faster, Automated Loan Processing

Digital mortgage technology makes loan processing easier by employing innovative workflow optimization and automation to offer faster and more reliable lending decisions. Our clients leverage our APIs and integrations to refine workflows for their team, removing dead time, bottlenecks, and inconsistency.

Strong Compliance & Risk Protection

Maintaining guideline compliance is crucial for lending organizations to manage risks correctly. Our digital mortgage lending solutions follow stringent checks and balances to ensure that evolving guideline changes are implemented into IncomeXpert. Clients no longer need to keep internal spreadsheets current with the latest guideline changes, or train teams on the new changes. With IncomeXpert, we handle that for you and your team.

Seamless Integration with Mortgage Tools

Our digital mortgage lending platform offers innovative technological integration with state-of-the-art API connections that facilitate smooth information exchange between your systems. We can power your automation projects and integrate disparate systems using our API. This unlocks automated workflows where previously manual data entry was the only option.

Who Benefits from Digital Mortgage Lending Automation?

Mortgage lenders benefit considerably from digital mortgage lending automation systems, which offer various solutions to simplify workflow processes, facilitate better decision-making, mitigate risks, and contribute to more impactful business growth prospects.

Underwriting Teams

Digital mortgage technology like IncomeXpert is changing how underwriting teams leverage automation solutions to process documentation, analyze risks, and evaluate a borrower’s profile credentials. Critically, it automates otherwise manual tasks freeing the underwriter up for doing their key role of risk analysis.

Loan Officers & Processors

Digital mortgage lending technologies like automated document processing eliminate repetitive tasks, which allows loan officers and processors to build more meaningful relationships with their clients rather than spending time doing calculations and scenario evaluations. These solutions also give these professionals the insights they need to make better decisions and offer accurate lending recommendations.

Leadership Teams

Through digitizing the workflow, leadership teams gain analytics data and insights not possible when using manual processes. By unlocking the full potential of digital lending mortgage platforms, bank and credit union leaders can gain deeper insights into business performance by deciphering complex data and analytics to grasp the impactfulness of their operations, how well they manage risks, and the health of their respective lending portfolios. With this information, they can make better lending strategy decisions and improve their organizations’ growth trajectory.

Frequently Asked Questions

Digital mortgage lending is an approach to loan origination workflows that replaces conventional manual approaches with automated, data-driven processes. It uses APIs, automation, and AI-powered systems to accurately and securely scan and analyze financial document data from various sources, such as income statements, bank records, tax returns, and employment documents. Unlike conventional methods, digital mortgage lending systems employ machine learning models to automate traditionally manual tasks.

Digital mortgage lending technology speeds up approvals by eliminating manual loan processing steps. What would have usually taken underwriters weeks to achieve manually, digital platforms can now process in hours. With automated workflows, teams can check documents, calculate income, and assess them for risks using algorithms, not individual experience and understanding. These platforms can also determine loan case complexity and allocate tasks to appropriate team members for review and approval. When teams leverage digital mortgage lending solutions, they can expedite loan approval processes accurately.

Artificial intelligence algorithms offer insightful data analysis to assess complex financial documentation and determine potential risks underwriting teams may have initially missed. As machine learning continues to evolve and expand capabilities by analyzing massive data sets, the speed at which accurate information gets delivered will drastically reduce. Digital mortgage lending systems scan and analyze financial data from various sources, such as tax returns, credit histories, employment records, and bank statements, to name a few, to ensure accuracy and precision.

There are distinct differences between traditional and digital mortgage lending approaches that result in entirely different outcomes. Traditional mortgage lending involves paper-based processes that consume considerable staffing hours, where teams collect, review, and verify documentation and are prone to potential human error. Conversely, digital mortgage lending solutions leverage innovative, automated AI-powered processes to review documents, assess risks, and offer reliable decisions based on factual data. They are cheaper, faster, more accurate, and more compliant than conventional methods and can analyze large caseloads of complex financial data without delays.

Digital mortgage technology has completely changed how customers engage with financial institutions. It has eliminated the need for long-drawn and confusing loan application processes. Borrowers can now benefit from faster processing timeframes and real-time communication with lender organizations to determine the status of their loan applications. Digital mortgage lending platforms allow clients to submit their financial documentation online instead of making numerous visits to a physical branch. Borrowers save considerable time, receive accurate loan assessments, and experience a smoother application journey than previously, which, in time, will make them more loyal to their financial organizations of choice.

Testimonial