Mortgage Process Automationwith IncomeXpert

IncomeXpert scans documents to automate income analysis and eliminate human data entry. IncomeXpert provides you full reps and warrants for:

- Income Analysis Accuracy

- Guideline Compliance

- Data extraction accuracy

Automate to eliminate human error

Upload Tax Returns

Free your team from wasted time on manual data entry and the risk of human errors and typos.

Hybrid Automation

Use IncomeXpert manually or upload and automate the income analysis where you need a boost. No rigid all-or-nothing plans here.

Full Quality Control Review

All automation files have a full domestic Quality Control review before being released to the client.

All Employed And Self-Employed Income

Single source of truth for all income analysis. Tax forms, W2, Paystubs, VOE, VOI, Profit and Loss.

Ready to request a demo with BluePrint today?

Income Types Supported

Employed (W2)

Employed (Paystub)

Employed (VOE / VOI)

Rental Income

Schedule 1

Schedule C

Schedule E

Schedule F

1065 & K1

1120

1120S & K1

Workflow

You upload the documents, our software scans them and determine what income is present and who it belongs to. Our software extracts the data and set up income calculators for you automatically.

01

Create

Create a loan and add the borrowers. This tells IncomeXpert which borrowers to target during the scan.

02

Upload / Scan

Upload tax returns, W2, VOE, or VOI to start the mortgage automation income analysis process.

03

Quality Control

IncomeXpert notifies you that the scan and QC checks are finished.

04

Report

IncomeXpert notifies you QC is complete and you can review your full income report.

What about data entry errors?

We have you covered with IncomeXpert. A data entry error can ruin correct arithmetic and guideline compliance. We can remove the human error from data entry and provide full reps and warrants against data entry errors by using IncomeXpert.

IncomeXpert allows your team to upload tax returns, VOE, paystubs and other income documentation and our software will scan and extract the data from the form. Many companies can do this, scanning and extracting data is nothing new to the mortgage industry. Blueprint has refined this technology and gave it a smart workflow to ensure you get quality data.

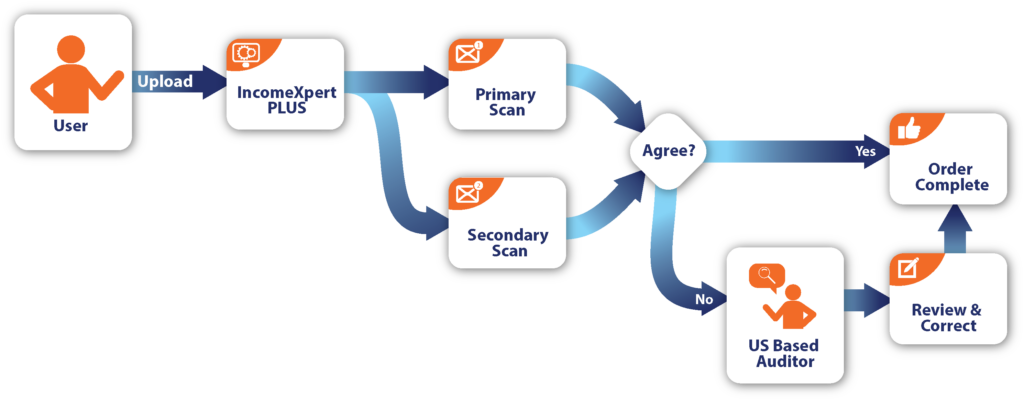

OCR Isn’t Perfect

Scanning technology is not perfect. Everyone knows this, so how can we reliably use it? Blueprint created two independent scanning solutions using diverse technologies. We scan and extract each page twice. When we get a disagreement between the two, it is routed to a US-based human auditor to correct any discrepancy.

The end result is you get assurance and full reps and warrants that the income data is entered correctly. For a full list of income types and document types that we support, please consult this article.

A Complete Income System

IncomeXpert gives your team complete coverage for all income types across the five major agencies, combined with full reps and warrants against income calculation errors, as well as data entry errors. IncomeXpert is a one stop shop for your entire mortgage automation operation.

FNMA Income Calculator

Users of the IncomeXpert automation can also leverage FNMA Income Calculator to their income analysis. Learn More.

Buyers Guide to Automated Income Analysis

Are you looking to setup an automated income analysis system at your company? If you are looking to build your own, or consider a vendor such as Blueprint, we have a resource for you to help. We created a checklist to guide any implementation. Click the link below to get the report.

As Seen In / As Used By

Testimonial

Frequently Asked Questions

Mortgage process automation refers to using technology and software to handle routine tasks in the mortgage industry. This approach replaces manual input with automated mortgage processing systems that perform calculations, verify data, and track compliance measures. Mortgage automation software assists lenders in executing mortgage loan automation while reducing reliance on outdated manual methods. By integrating mortgage automation technologies, teams gain clarity on data, minimize errors, and adhere to agency guidelines. The result is a reliable process that supports faster decision-making and improved risk management. Blueprint offers a mortgage automation platform to handle these critical tasks precisely and confidently.

Automation in mortgage processing employs intelligent systems to transition from manual methods to automated mortgage processing workflows. Lenders benefit from tools that handle repetitive calculations and data analysis through mortgage automation technologies. Automation streamlines mortgage workflows to reduce mistakes while highlighting areas requiring further attention. Organizations adopt mortgage automation services to convert traditional processes into a well-defined, straightforward process that enhances operational confidence. This method allows professionals to focus on higher-level decision-making instead of manual tasks. Blueprint delivers a solution that manages complex calculations and compliance with agency guidelines, which lets you make informed decisions quickly.

Mortgage automation is crucial in reducing underwriting errors by automating the analysis of income and risk factors. Mortgage automation software takes over tasks typically handled by manual data entry, which reduces the possibility of human error. Through automated mortgage processing, data is analyzed according to established guidelines, which highlights discrepancies early. Mortgage loan automation uses a robust system that detects and documents adjustments to give underwriters a clear trail of modifications. This data clarity minimizes calculation mistakes and supports a more transparent review process. Blueprint’s platform uses advanced mortgage automation technologies that integrate real-time alerts and role-based permissions to maintain rigorous oversight throughout the underwriting process.

Mortgage process automation does not eliminate the role of underwriters. Instead, it equips underwriting teams with powerful mortgage automation software that handles routine calculations and data verification tasks. Automated mortgage processing delivers reliable data, which enables underwriters to concentrate on evaluating risk and making strategic decisions. Mortgage automation services support a system that documents every action while allowing underwriters to review and approve calculations confidently. The technology provides clear audit trails and additional guidance without taking away the professional judgment of the underwriter. Blueprint’s solution works alongside your team and offers a mortgage automation platform that enhances accuracy and supports informed decision-making while preserving the underwriter’s critical role.

Mortgage automation transforms the borrower experience by promoting accuracy and transparency in the loan approval process. Automated income analysis allows lenders to deliver an experience for borrowers that reduces delays caused by manual errors. Borrowers receive faster application updates as mortgage automation technologies process income data reliably. Mortgage workflow automation creates a system where we record every step, thus offering clarity and accountability from application through closing. This process provides a more structured experience for the borrower, with improved communication and reduced uncertainty. Blueprint leverages a mortgage automation platform that supports accurate assessments, which results in a smoother, more predictable experience for every customer.