Automated and Guided Mortgage Income Analysis

IncomeXpert automates and guides users to calculate a guideline-compliant mortgage income analysis every time.

Intelligent Mortgage Income Analysis & Compliance Solutions

AI-Powered Mortgage Income Analysis

Our mortgage income verification software leverages advanced AI technology to extract, validate, and compute mortgage income analysis from uploaded financial documents. The platform delivers precise income calculations while maintaining strict adherence to agency guidelines. This automated income analysis platform manages intricate scenarios with exceptional clarity and consistency.

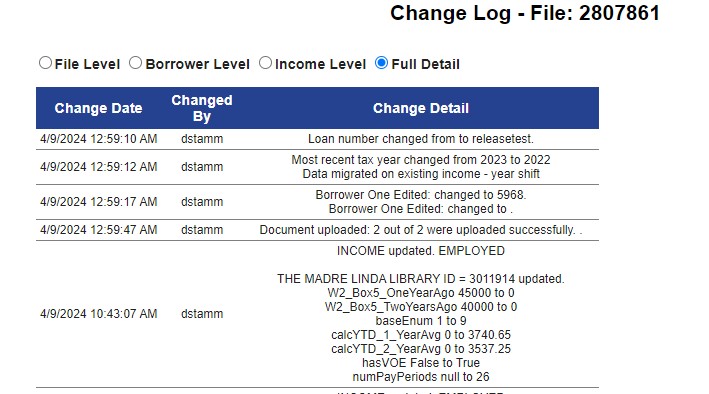

Change Log & Audit Trail

Our mortgage income analysis system documents every modification through a detailed audit log that captures all income adjustments. This comprehensive change tracking supports compliance audits and risk management protocols. Time-stamped records provide complete transparency for underwriters and auditors reviewing mortgage income verification software results.

Guideline Coverage

Lenders can rest easy knowing IncomeXpert has checked all the guidelines and applied advisories and conditions to their mortgage income analysis. All agencies are covered, so you have full rep and warrant coverage on guideline compliance.

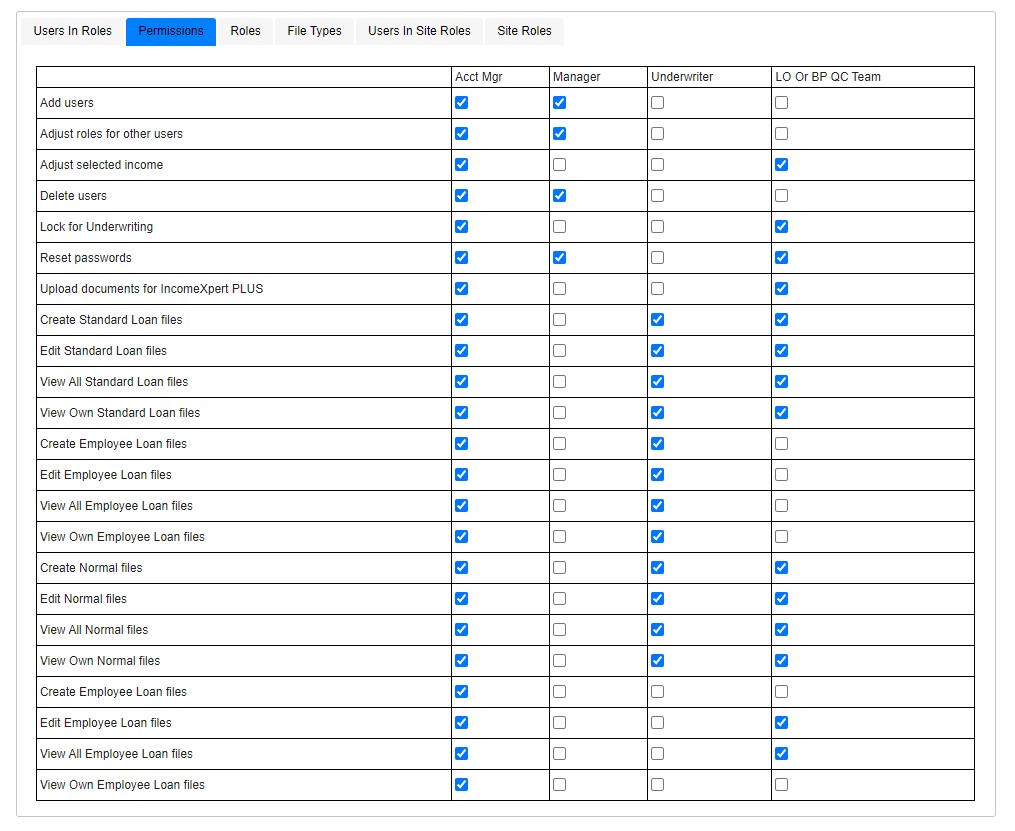

Role Management & Access Control

Our mortgage income verification software delivers sophisticated controls for managing user roles and system access. The platform restricts sensitive operations exclusively to authorized team members. This role-based security enhances accountability and protects critical income data throughout the mortgage income analysis evaluation process.

What is mortgage income analysis?

Mortgage income analysis represents the thorough assessment of a borrower’s qualifying income using mortgage income calculation worksheets and specialized mortgage underwriting tools like FNMA Income Calculator to establish loan eligibility. This mortgage income verification process encompasses evaluating W-2 wage earners, applying self-employed income worksheets, utilizing variable income calculators, and examining additional income sources to deliver accurate qualifying income.

What is mortgage cash flow analysis?

Mortgage cash flow analysis evaluates business income amount, income trends, and income stability using self-employment income calculation worksheets. Cash flow analysis is required by all GSEs and must be done to ensure eligibility, and stability of the income.

Why is mortgage income analysis important?

Income analysis prevents loan defaults by ensuring borrowers can sustain payments using accurate income calculation worksheets for mortgage applications. Proper analysis with tailored employed and self-employed income worksheets, supporting trending analysis, and selling guide reviews can eliminate repurchase risks and protects both lenders and borrowers.

Why automate income verification?

Mortgage technology has advanced beyond manual Excel processes. Automated mortgage income analysis eliminates human errors while processing complex tax returns that can span thousands of pages. This automation using advanced mortgage income calculator worksheets solves the needle-in-haystack problem of finding applicable income data.

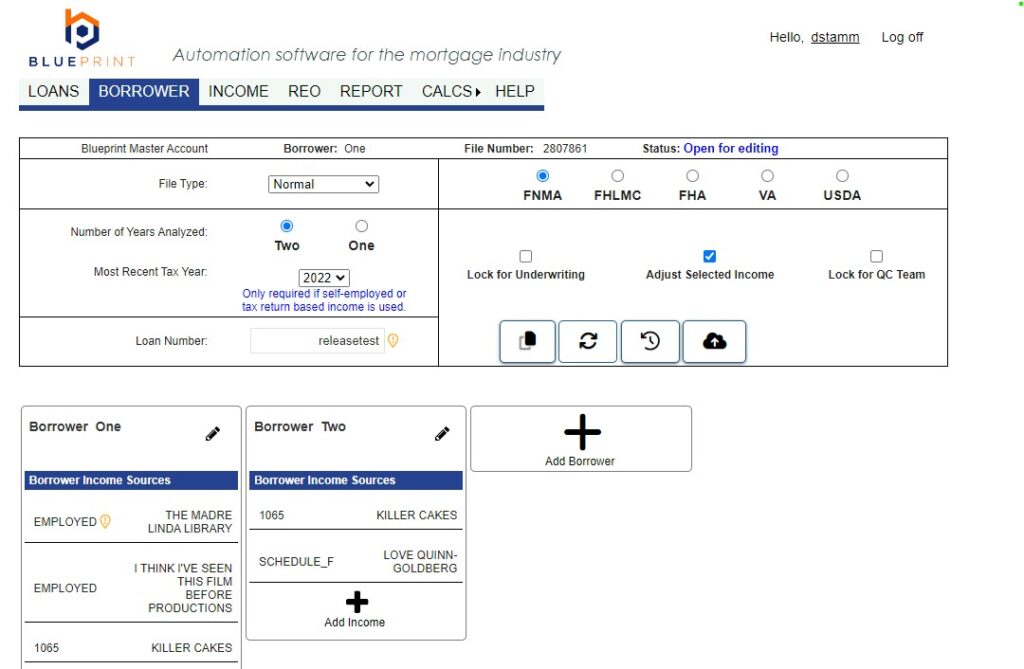

Agency-specific mortgage income analysis

IncomeXpert performs mortgage income analysis tailoring calculations to agency guidelines (FNMA, FHLMC, FHA, VA, or USDA). Our automated income analysis platform rejects one-size-fits-all methodologies, instead considering each agency’s distinct compliance requirements to deliver agency-compliant mortgage income analysis using specialized mortgage income calculation worksheets.

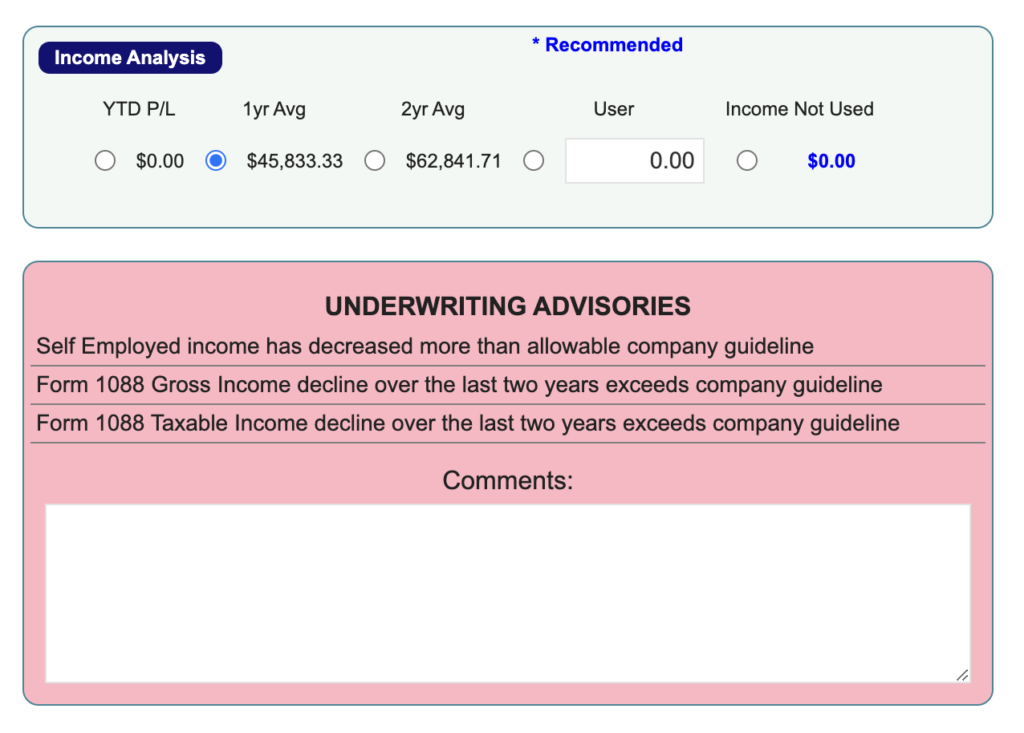

The story behind the numbers

A good mortgage income analysis is not just the numbers, it’s the story behind the numbers. IncomeXpert provides underwriting advisories and income opportunities using comprehensive mortgage income calculator worksheets.

Underwriting Advisories

Underwriting advisories are alerts added to the mortgage income analysis to guide the reader to look more carefully at the provided data and warn of areas where compliance or guideline infractions may occur. Many times these alert the reader to additional documentation needed to justify the income using self-employed income worksheets or Schedule C income calculators. Without additional documentation, the income may be non-compliant or require documenting 36-month continuity.

Income Opportunities

Income opportunities are areas users might be missing to maximize the borrower’s qualifying income using variable income calculators or FNMA income calculation worksheets. These are areas where lenders might be “leaving money on the table” by not utilizing comprehensive calculating income for mortgage underwriting worksheets.

Why automate mortgage income analysis?

Mortgage technology has advanced significantly and users should not be using Excel or manually entering data to perform mortgage income analysis. Humans are fallible and error-prone. Additionally, complex tax returns can be thousands of pages long requiring deep reading to gather applicable pages – a needle in a haystack problem. By using automation to scan and review documents, users can focus on risk analysis, underwriting advisories, and income opportunities, not on data entry.

How we ensure error-free income

Guaranteeing error-free mortgage income analysis demands attention across multiple loan aspects, including guideline compliance, advisory implementation, and deviation tracking. Continue reading to understand how IncomeXpert achieves error-free mortgage income analysis through our automated income analysis platform.

Guidelines

Accurate mortgage income analysis begins with comprehensive adherence to agency guidelines. IncomeXpert incorporates guidelines from FNMA, FHLMC, FHA, VA, and USDA to provide an extensive mortgage income verification software suite enabling lenders to qualify more borrowers using specialized mortgage income calculation worksheets. Our compliance team maintains current awareness of guideline modifications and deploys timely updates, eliminating one more concern for your underwriting team.

Advisories

Agency guidelines can prove overwhelming, which is why our automated income analysis platform provides targeted advisories to help teams navigate requirements using our mortgage income calculator worksheets. In aggregate, we deliver over 200 underwriting advisories. These advisories signal when borrower income fails to qualify under agency guidelines, and also when additional risk analysis by underwriters may be necessary to qualify income within our mortgage income verification software.

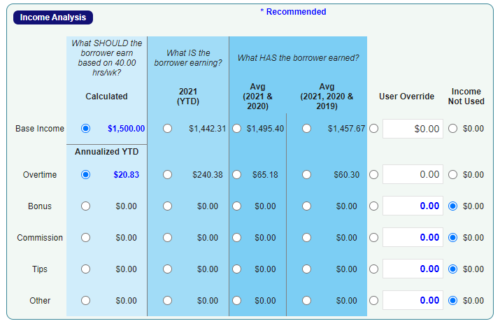

Multiple Calculations

IncomeXpert computes all averages, trending analysis, and supporting calculations required to satisfy agency guidelines using comprehensive income calculation worksheets for mortgage applications. The mortgage income analysis system performs numerous calculations before arriving at our final income recommendation.

Underwriters maintain authority to override recommended values when professional judgment requires adjustment. Override capability is controlled through permissions in our role manager, restricting this function exclusively to authorized personnel within the automated income analysis platform.

Book a Discovery Call Today.

Identify deviations

Our mortgage income verification software designates income with a distinctive icon whenever users deviate from recommended income values in our FNMA income calculation worksheets. This visual indicator enables auditors and senior underwriters to rapidly identify specific income entries requiring review to understand the underwriter’s rationale for the deviation from our automated income analysis platform recommendations.

Roles and Permissions

The role manager within our mortgage income analysis system controls access and functionality across users working with different mortgage income worksheets. Functionality can be precisely tailored for loan officers, processors, underwriting staff, IT personnel, and administrative teams. Loan creation, user management, underwriting lock status, and recommended income deviation authority can all be governed through role management in our mortgage income verification software.

Change Log

Who modified what information and when? IncomeXpert maintains a complete change log history documenting every edit made to loan files within our mortgage income analysis system. This provides maximum visibility and transparency across all operations. Modifications to add, remove, or edit borrowers, income sources, and even individual income field values are tracked and time-stamped with user attribution through our automated income analysis platform.

Full Reps and Warrants

Blueprint’s confidence stems from our 10+ year operational track record without a single repurchase demand, enabling us to provide comprehensive representations and warranties protecting against calculation errors and guideline violations in our mortgage income analysis platform. This industry-leading warranty coverage distinguishes our mortgage income verification software from competitors.

As Used By

Testimonial

Ready to get started with BluePrint?

Frequently Asked Questions

Mortgage income analysis is a comprehensive process that involves calculating and evaluating a borrower’s income to support sound lending decisions. Lenders rely on tools such as a mortgage income calculation worksheet to derive accurate results. Financial institutions use Blueprint to calculate income for variable incomes and scenarios. The process complies with guidelines and uses tools such as the Fannie Mae Income Calculator and income worksheet, which offers a complete picture of a borrower’s financial capacity.

Income analysis plays a vital role in mortgage lending by clarifying borrowers’ repayment ability and reducing risk. Lenders utilize tools such as an income calculation worksheet for mortgages and the FNMA self-employed income worksheet to derive precise income figures. Blueprint presents a comprehensive approach that verifies income details across various scenarios, including self-employed and variable income situations. This process helps avoid errors that might lead to loan repurchase demands and supports a robust evaluation of the borrower’s overall financial health and stability.

Lenders verify a borrower’s income by gathering and examining various documents and data sources. They may use a mortgage income worksheet to record numbers, relying on tools like the FNMA Income Calculator , and variable income calculators to assess reported earnings. Blueprint integrates these resources to cross-check tax returns, pay stubs, VOE/VOI and W2s to calculate income. This process results in a comprehensive assessment highlighting discrepancies and confirming the borrower’s income reliability for underwriting decisions.

A complete mortgage income analysis typically requires multiple documents to thoroughly understand a borrower’s financial situation. Lenders request tax returns, pay stubs, bank statements, and additional records such as W-2 forms and profit and loss statements. We also employ tools like the FNMA Income Calculator. Blueprint accommodates these requirements by processing each document individually , which allows for a thorough analysis that supports adherence to regulatory guidelines and accurate income calculation.

Automation transforms mortgage income assessment by replacing traditional manual processes with calculated, technology-driven evaluations. Blueprint employs advanced tools such as a mortgage income calculation analysis , FNMA Income Calculator , and variable income calculator to process diverse income scenarios accurately. Blueprint addresses complex cases, including self-employed income, with a self-employed income analysis and Schedule C income calculator that automatically verifies data and highlights discrepancies. This technology-driven approach minimizes errors and delivers accurate results while maintaining compliance with industry standards, thereby enhancing the overall quality of income analysis for lending professionals.