The employed income calculator was updated in July 2024 with three additional options to improve the accuracy of income calculations for IncomeXpert. The three new controls are described below.

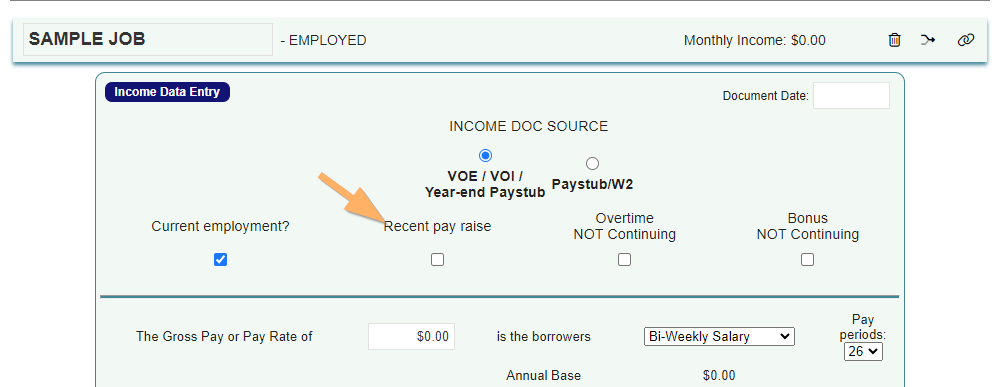

Recent Pay Raise

When a borrower recently receives a pay raise this income may not initially be recommended by IncomeXpert. The reason being is the YTD calculation will sometimes be lower than the income based on the new pay rate. The YTD calculation will be selected, and not the new calculated income if there is more than a ~3 percent difference in the two numbers.

If the underwriter can confirm the YTD income is low due to a recent pay raise, they can now utilize the Recent Pay Raise checkbox inside IncomeXpert. By checking this box IncomeXpert will utilize the new higher calculated income based upon the recent pay raise.

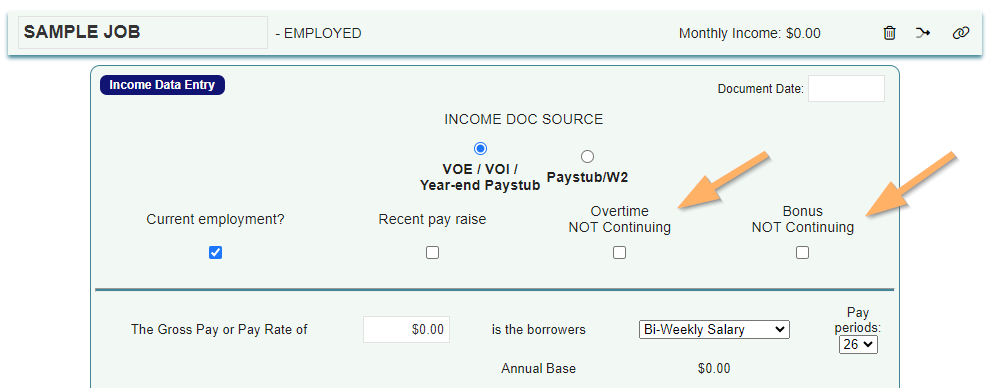

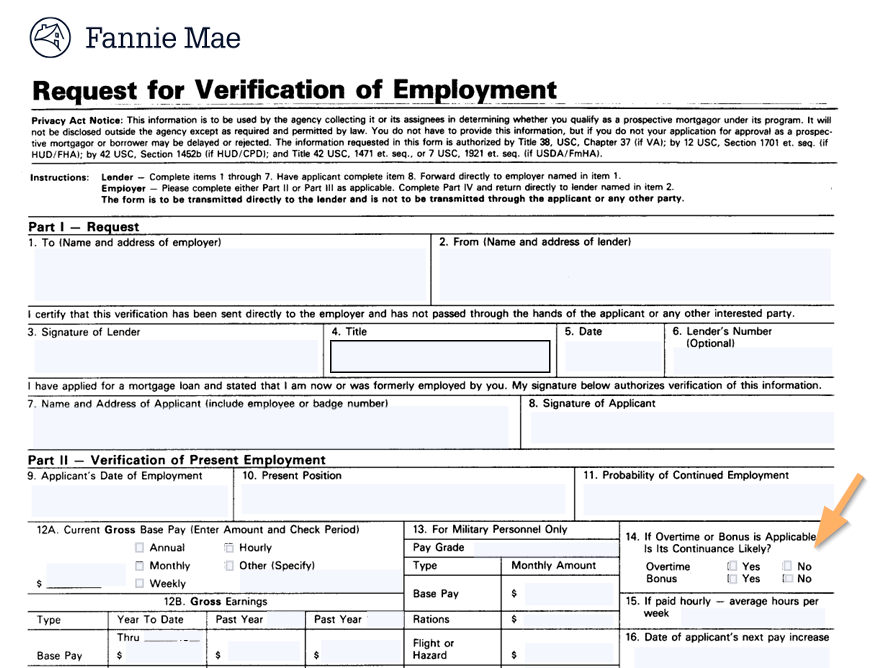

Overtime or Bonus Not Continuing

The verification of employment (VOE), also known as FNMA form 1005 or FHLMC form 90, has a box that requires the employer to confirm reasonable continuance of the variable incomes (overtime and bonus). All agencies require the loan originator to confirm that income is expected to continue within reason. If the employer checks the no box on either bonus or overtime, these income types can not be used. To exclude the overtime and/or bonus check the boxes and click the save/calculate button to update the income.