IncomeXpert provides clients with several controls to grant the right permissions to their team based on job position, for example loan officer / processor / underwriter. By default IncomeXpert allows all users to change the recommend income (highlighted in blue) and deviate to other income values. This works well for small teams and no further action or steps are needed, and these controls will NOT be displayed.

With larger teams where several differing roles are accessing the same IncomeXpert data, additional controls are available. The account manager can opt in to the set of controls for the restricts the ability to choose incomes other than the recommend income (blue highlighted number). If the account opts in, additional permissions assigned to roles can be utilized.

If your account wants to opt in for this control, please reach out to Blueprint Customer Support and they can opt in your account for these controls.

Once opted in, two permissions in Role Manager will take effect. The Adjust Selected Income permission and Lock for Underwriting permissions will now have an effect.

Adjust Selected Income Permission

IncomeXpert has a Adjust Selected Income feature which will restrict users who do not have this permission from deviating from the IncomeXpert recommended income values (i.e. radio buttons). In order to deviate from the recommended income, the Adjust Selected Income box must be checked on the loan file. This tells the software to follow the user’s selected income and stop using the recommended income value (blue highlighted value). The IncomeXpert recommendation will still be displayed, but deviating from this value is now possible.

Lock For Underwriting Permission

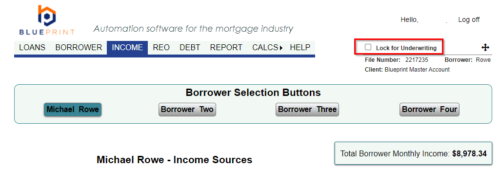

IncomeXpert has a Lock for Underwriting feature which will restrict users who do not have this permission from editing the loan file. This lock will prevent users without this permission to make any changes to the loan file including any name data, income data, choosing any qualifying income (the radial buttons), and notes. The lock for underwriting can be set on the Borrower page in the upper right hand corner by those user with “underwriting” permission turned on. NOTE users with this permission can turn on or turn off this lock, be advised by clearing the lock all users in the account can make changes to the loan file.

Detailed Information

Effective July 1, 2022 all files created on or after this date will change the way the income on the loan is set. Currently IncomeXpert only recommends an income value by highlighting it in blue. After July 1, 2022 IncomeXpert will automatically select the recommended value until the Adjust Selected Income flag or Lock for Underwriting flag is set on the Blueprint loan file.

In the image above the pre-July 1, 2022 behavior is shown. The user has selected the 1yr average even though the 2yr average is recommended.

Loans created in Blueprint after July 1, 2022 will have a new behavior. Prior to the Adjust Selected Income or Lock for Underwriting flag being set, the selected income will be the recommended value indicated in blue.

To set the Adjust Selected Income or Lock for Underwriting the user must have the correct permission to do so. On the borrower page there is a checkbox where the flag can be set.

Refer to this article on setting Roles and Permissions for users.

Once the Adjust Selected Income or Lock for Underwriting flag is set, the ability to adjust the radio buttons to a selection different than the recommended value is unlocked for some users. By having two permissions (Adjust Selected Income and Lock for Underwriting) this gives teams the ability to tailor the editing permissions to meet the needs of the business.