Accelerate Lending Workflows With Blueprint's Income API

Blueprint’s API provides automated financial assessment tools that help banks, credit unions, and lenders eliminate errors, streamline workflows, and enhance accuracy. Our comprehensive API gives you programmatic access to everything in IncomeXpert, allowing you to create automations, reduce manual entry, and integrate our solution directly into your existing systems, all via a powerful Blueprint API.

Eliminate Manual Data Entry

The Blueprint API enables seamless integration with your existing systems to automatically transfer information, eliminating the need for duplicate data entry. Connect your LOS, document management system, or custom applications directly to Blueprint to create a streamlined workflow that reduces errors and saves valuable time.

Accelerate Decision Making

When integrated with your systems through Blueprint’s income API, our automated processing can reduce processing time from hours to seconds. Automatically upload documents, process calculations, and receive analysis results back into your system, enabling faster approvals and better customer experiences.

Full Reps and Warrants Coverage

Like our core product, our API integration provides complete representations and warranty protection for all calculations. Our dual-layer quality control system ensures audit-ready, highly accurate results that you can trust, whether accessed through our interface or via API.

Blueprint API Features

Ready to request a demo with Blueprint today?

Comprehensive Developer Resources

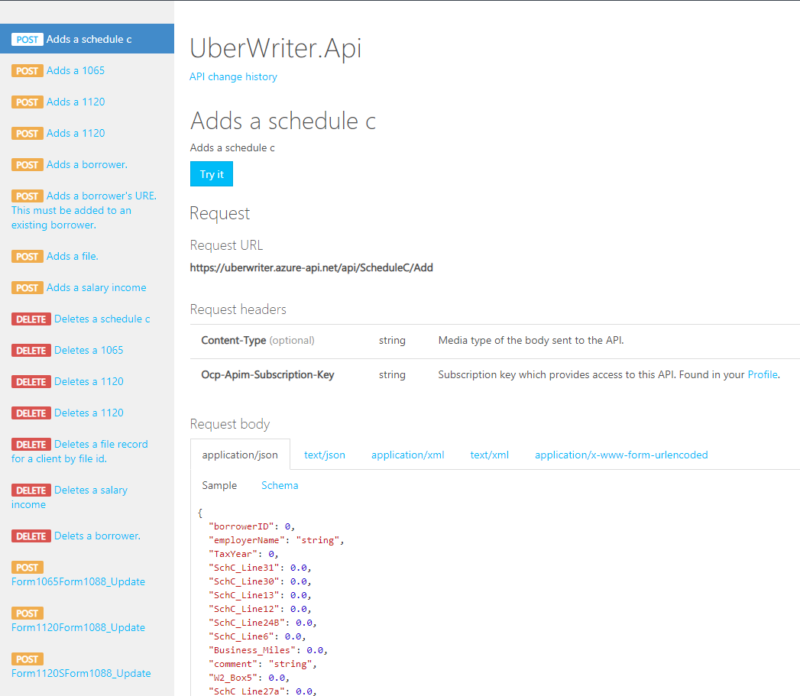

Interactive Developer Portal

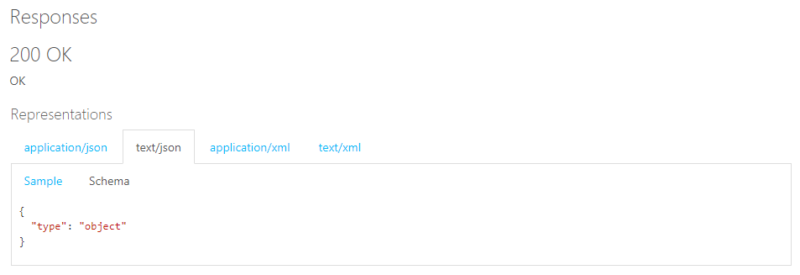

The Blueprint API developer portal provides comprehensive documentation, authentication guides, and interactive testing tools. Experiment with API endpoints in real-time before implementing them in your production environment.

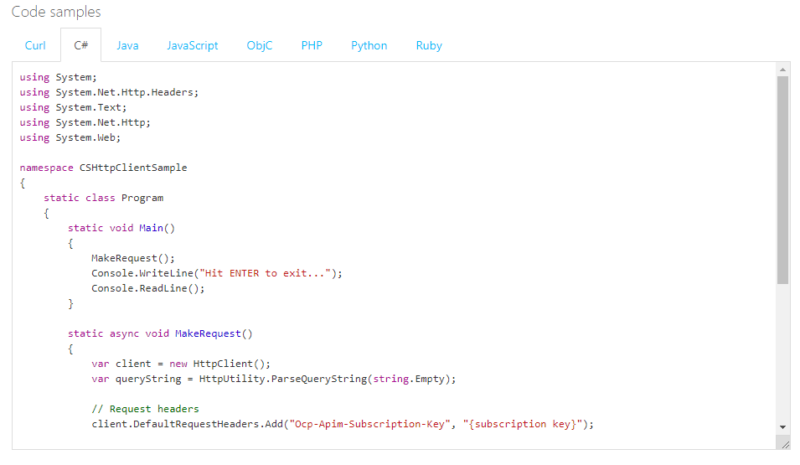

Language-Agnostic Implementation

Access our API using any programming language with examples provided in Python, JavaScript, Java, C#, and more. Our RESTful API follows industry standards for easy implementation in your existing codebase.

Secure Authentication

Our API implements OAuth 2.0 for secure authentication and authorization, ensuring your data remains protected while enabling seamless integration with your existing security infrastructure.

Reliable Webhooks

Configure webhooks to receive real-time notifications when income analyses are completed, enabling automated workflows that keep your lending process moving efficiently.

How Blueprint API Transforms Your Lending Operations

Seamless System Integration

Blueprint's API provides straightforward integration with your existing technology stack. Whether you're using Encompass, another LOS, or custom applications, our RESTful API enables secure, reliable communication between systems, maintaining data integrity throughout the lending process.

Automated Document Processing

Leverage our API to automatically route documents for analysis as soon as they arrive in your system. Our OCR technology extracts and validates data from tax returns, paystubs, and verification documents without manual intervention, while still maintaining the option for human oversight when needed.

Who Benefits from Blueprint API Integration?

Technology Teams

Easily build custom workflows and automation that integrate Blueprint’s capabilities directly into your proprietary systems. Our comprehensive API documentation makes implementation straightforward, reducing development time and maintenance complexity.

Operations Leaders

Streamline your origination process by eliminating manual data transfer between systems. Blueprint’s API enables straight-through processing where possible while maintaining appropriate human oversight, reducing processing time and improving accuracy.

Compliance and Risk Teams

Maintain consistent calculation standards across your organization with API-driven automation. Every analysis performs the same rigorous checks with full audit trails, ensuring compliance with agency guidelines regardless of which underwriter handles the application.

FAQs About Blueprint API

The Blueprint API provides access to all core functionality, including document upload, data source creation, automated calculation, guideline advisory notifications, and final reporting. You can create new analyses, update existing ones, and retrieve results programmatically, enabling seamless integration with your existing systems.

Blueprint’s API is designed to work with any loan origination system. For Encompass users, we offer a native integration that synchronizes borrower data and final calculations between systems. For other LOS platforms, our RESTful API provides standardized endpoints that can easily connect to your existing infrastructure, with webhooks for real-time notification of analysis completion.

Blueprint implements industry-standard security practices including OAuth 2.0 authentication, TLS encryption, role-based access controls, and comprehensive audit logging. Our API follows the principle of least privilege, allowing you to create tokens with precisely the permissions needed for specific integration purposes.

Most clients can implement basic API integration within 2-4 weeks depending on the complexity of their desired workflow. Our developer documentation includes implementation guides, sample code, and testing environments to accelerate development. The Blueprint team also provides integration support throughout the process to ensure a smooth implementation.

Yes, we provide sandbox access to our API for testing and development purposes. This allows your team to explore the API capabilities, test integration points, and validate your implementation plan before moving to production. Contact our sales team to arrange sandbox access and a technical consultation.

Testimonial