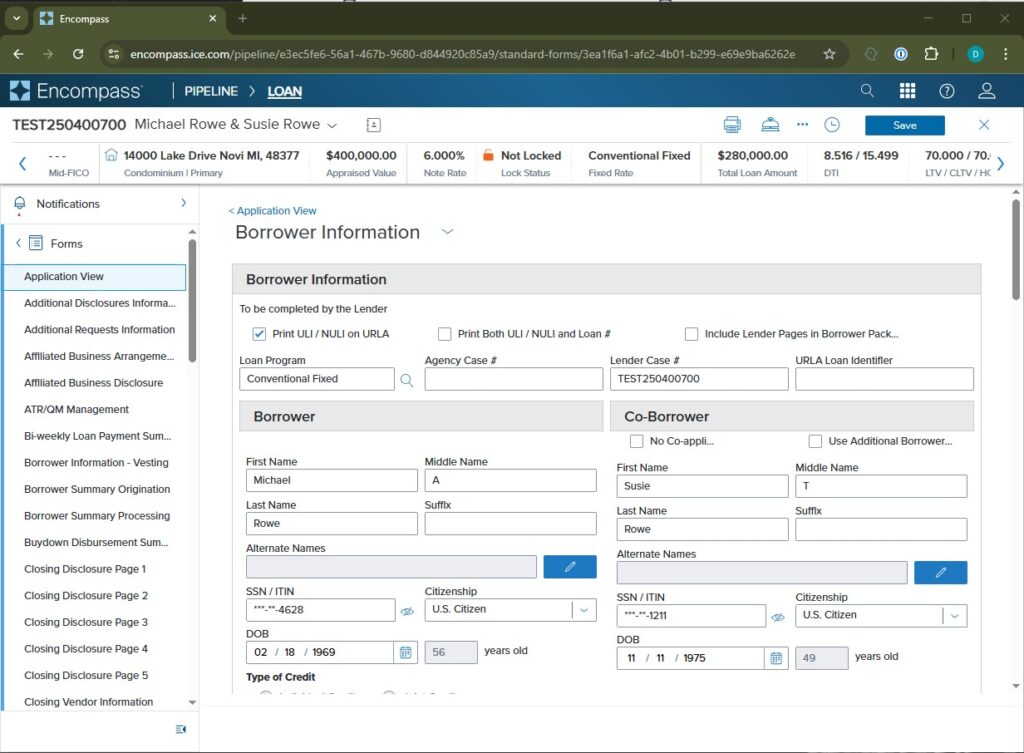

Encompass Mortgage Integration

Optimize your mortgage operations from messy and error-prone to smooth and compliant by integrating Blueprint’s IncomeXpert with your Encompass mortgage software. Our seamless integration connects your loan files directly to our powerful income analysis tools, eliminating duplicate data entry and streamlining your workflow. When analysis is complete, results are sent back to Encompass, updating your loan file automatically.

No Manual Data Entry

Blueprint’s integration with Encompass mortgage software eliminates the need to re-enter borrower information that’s already in your system. Our connection pulls relevant data directly from your loan files, creating a ready-to-analyze framework in IncomeXpert. This seamless transfer ensures data consistency between systems and significantly reduces the time spent on repetitive tasks.

No Calculation Errors

Maintaining accuracy is crucial in mortgage underwriting processes. Blueprint’s IncomeXpert ensures that underwriting teams achieve this business objective by employing advanced calculation validation mechanisms to automatically verify financial particulars like income verification and qualification assessment. As such, underwriters can trust the consistency and accuracy of their financial assessments due to unparalleled mathematical precision, substantially reducing the likelihood of human errors.

No Data Transfer Errors

Blueprint’s integration with Encompass eliminates manual transcription errors when moving data between systems. When your income analysis is complete in IncomeXpert, our integration ensures that final results are accurately transferred back to Encompass, updating your loan file with precise income calculations and automatically archiving the income analysis report for future reference and compliance.

Blueprint By the Numbers

Founded in 2013

Speed Up Decisions with Seamless Data Flow

Save Time on Complex Calculations

Simplify complex calculations without manual intervention using Blueprint's system integrated with your Encompass mortgage software. Our IncomeXpert performs intricate income computations that provide instant insights into borrower qualification while your loan data stays synchronized between systems. Blueprint's system offers detailed income assessments quickly and accurately, thus enabling underwriting teams to make decisions that further their business objectives without jumping between disconnected tools.

Stay in Control with Flexible Overrides

Although Blueprint's IncomeXpert features robust automated checks, it also incorporates necessary human expertise, which is critical to ensure the most beneficial and optimized outcomes for a business's lending processes. Experienced underwriters can override flexible protocols to enable their teams to make better, compliant choices that meet an organization's risk management regulations while maintaining a consistent data flow with Encompass.

Ready to request a demo with Blueprint today?

How Our Encompass Integration is Different

Built for Workflows

Blueprint’s integration with Encompass respects your existing loan origination workflows. Our connection points are designed to complement your process without disruption, letting teams maintain their established procedures while gaining the advantages of specialized income analysis. Data flows naturally between systems at the appropriate stages of your mortgage lifecycle.

Advisories To Stay Ahead of Guidelines

Blueprint’s IncomeXpert facilitates proactive compliance management by offering real-time advisories that keep your underwriting team abreast of changing income verification regulations. Our integration ensures these insights are available within your Encompass workflow, helping identify potential issues before they can disrupt your lending operations.

Full Reps & Warrants

Blueprint offers comprehensive representations and warranty protection coverage for our income calculations, providing peace of mind as data moves between systems. Our integration with Encompass maintains extensive records and provides tracking capabilities, making it easy to find what you need when needed and allowing you to respond to inquiries quickly.

Human guided Automation

Blueprint’s integration with Encompass facilitates a healthy cohesion between technology and human expertise. While we automate the tedious aspects of data transfer and income calculation, we ensure professionals can intervene at any point to make necessary adjustments. This balance of automation and control ensures optimal results without sacrificing flexibility.

Improving Work Flow with Blueprint and Encompass

Blueprint’s integration with Encompass offers a streamlined connection between your loan origination system and specialized income analysis tools, making resource allocation easier, reducing operational discrepancies, and creating a holistically unified approach to managing mortgage workflows.

Simplifying Borrower Data Management

Optimize borrower information management with Blueprint’s integration tools that eliminate redundant data entry between Encompass and IncomeXpert. Our connection extracts crucial data from your Encompass loan files using sophisticated data transfer protocols that maintain data integrity throughout the process, ensuring consistent and accurate borrower profiles that facilitate more nuanced income analysis for lending organizations.

Automating Income Reports

Traditional income verification processes are time-consuming. However, Blueprint’s IncomeXpert allows lending entities to generate accurate automated income analysis documentation that integrates seamlessly with Encompass. Our technology breaks down complex income documents to extract and validate data from different sources, including variable pay, multiple income streams, and uncommon employment structures, to help underwriting teams make faster and more manageable financial assessments that flow back into Encompass.

Streamlining Underwriting Workflows

Blueprint’s integration with Encompass optimizes underwriting workflows with tools that connect naturally to your loan review cycle with minimal manual intervention. Our system coordinates the flow of information between platforms at the right stage of the process, transforming conventional underwriting into a responsive, data-driven lending ecosystem where income analysis feeds directly back into your loan origination system.

FAQs About Encompass Mortgage

Blueprint has developed a seamless integration with Encompass that allows users to connect an existing loan file to our IncomeXpert platform. This integration transfers borrower information already stored in Encompass to Blueprint, eliminating the need for duplicate data entry. When the income analysis is complete in Blueprint, the results can be automatically sent back to Encompass, updating the loan file and archiving the income analysis report for future reference.

Blueprint’s IncomeXpert employs advanced algorithmic calculations to automate income verification processes by quickly analyzing different income sources, such as multiple job holdings, self-employment streams, and variable pay structures. By connecting directly to Encompass, Blueprint eliminates manual data transfer time and substantially increases accuracy. The system cross-references and validates information, facilitating a dynamic income verification system that can simplify complex income scenarios to help underwriting teams easily handle intricate financial structures without duplicating work between systems.

Blueprint’s IncomeXpert stays abreast of evolving income calculation guidelines and regulations, automatically checking for discrepancies, maintaining audit trails, and instantaneously alerting users when it detects non-compliance errors. When integrated with Encompass, this compliance information becomes part of your loan file’s permanent record. Blueprint’s approach transforms conventional compliance from a reactive process to a calculated operational asset by creating an anticipatory risk management framework that works within your existing Encompass environment.

Blueprint’s integration with Encompass leverages established APIs to connect with your existing system synchronously, allowing for optimized data sharing without disrupting daily workflows. We offer specialized onboarding to set up the integration incrementally so that ongoing changes do not affect existing workflow processes. Blueprint employs streamlined connection technologies that automatically map and transfer data between systems to ensure optimized integration, resulting in a unified ecosystem that maintains operations continuity.

Blueprint’s IncomeXpert justifies the transition from conventional spreadsheet approaches to integrated income analysis by offering calculation tools that eliminate the need for manual data entry between systems. With our Encompass integration, you’ll experience more precise results, expedited processing timeframes, and improved compliance tracking, all while maintaining connection to your primary loan origination system. Blueprint provides unparalleled computational capabilities, reliable compliance tracking, and optimized operational effectiveness that extend the power of your Encompass investment.

Testimonial