One of the most common questions we receive from clients with borrowers who are self-employed is “Why did Blueprint subtract income when it shows a positive number on my business tax form?” This article will explain those instances and how to adjust your review accordingly.

The following line items are examples of types of incomes that are referred to in the guidelines as ‘non-recurring income/losses’. These items reflect income or expenses that are not considered primary to the business—they are classified as secondary.

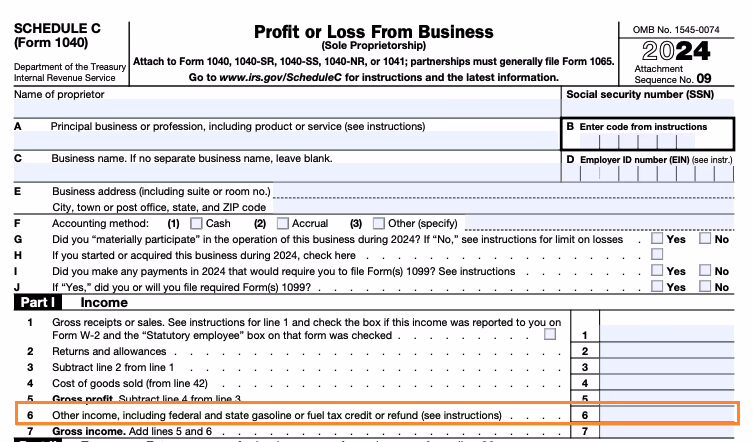

Schedule C Line 6

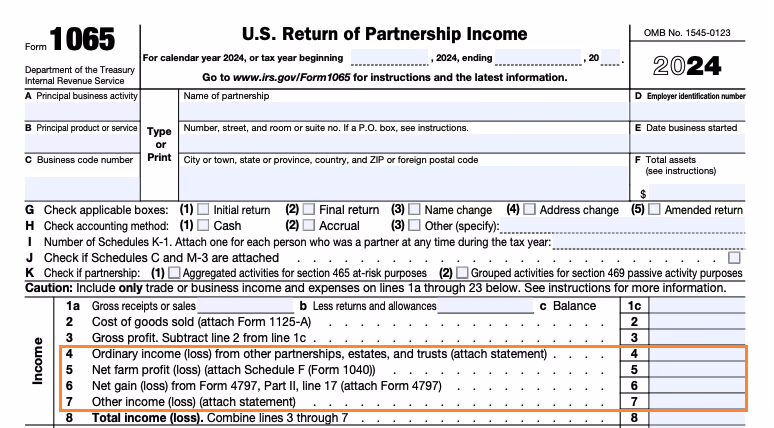

1065 Line 4 / 5/ 6 / 7

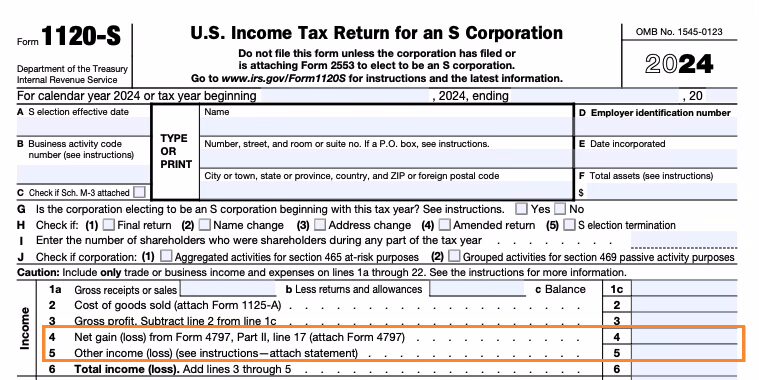

1120S Line 4 / 5

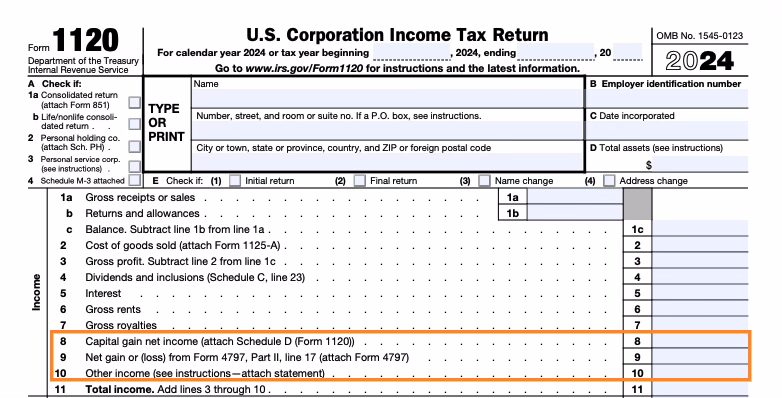

1120 Line 8 / 9 / 10

These amounts are typically subtracted from the borrower’s qualifying income (based on their ownership percentage) unless your team can provide documentation showing the income has been received for at least two consecutive years and is reasonably expected to continue for the next three years. The line item can be moved back to $0 when the income is confirmed as meeting the guidelines for use.

If there is a loss reported on these lines, the same principle applies: the loss may be added back (in other words a “positive” number in the related line) if your team can document that it was a one-time event and is not expected to continue.

Keep in mind, our team cannot make the determination to reduce the income or add back the loss, as it requires your underwriting team to evaluate and document whether the income or loss meets the criteria for stability and continuance.

Need Help?

If you have any questions or need support, contact the Blueprint team at:

info@getblueprint.io

Support Hours: Monday–Friday, 8:00 AM – 6:00 PM (Eastern Time)

Closed: Weekends and U.S. federal holidays