As lenders, we have all heard of reps and warrants and programs like Day One Certainty (D1C), but do we really understand them? Lenders rightfully seek out reps and warrant relief where possible to shift risk away from their business, but some lenders are unclear or misinformed on how to truly get the relief they are seeking. Many times people say reps and warrants, and the inference is the entire loan is rep and warranted. However, when you dig more deeply, you will see that is not what is actually provided. If you as a leader want to seek out as much rep and warrant relief as possible, there are three main challenges you will find.

Why do you want Reps and Warrants?

Seems obvious, but what is the underlying rationale? What is the tangible benefit to the company? Representations and warranties are about shifting risk for specific tasks out of your organization and placing the risk on a 3rd party. Risk abatement is the fundamental end goal of seeking reps and warrants.

Much like automobile insurance, you pay such that your risk of an automobile theft or collision can be mitigated financially by a third party. If an error occurs in your rep and warranted loan, you can make a claim and recoup financially from your loss.

What is Covered?

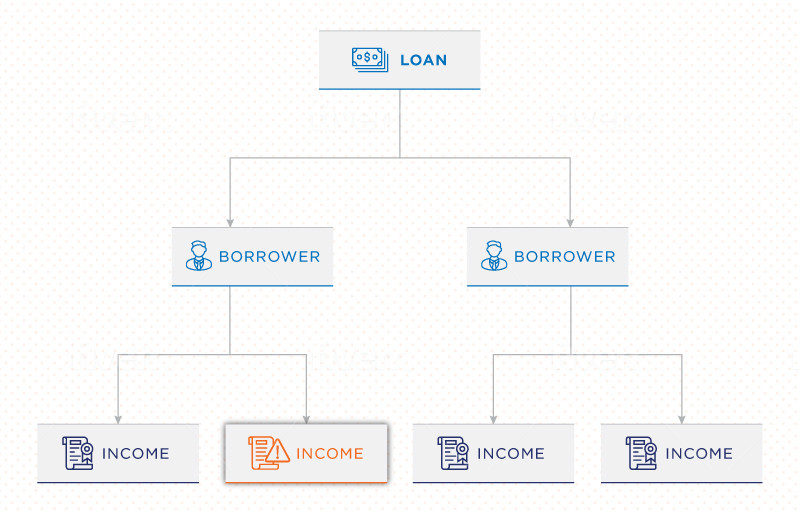

First, programs like Fannie Mae’s D1C, and the new FNMA Income Calculator and FHLMC AIM program offer income by income relief, not a blanket “all” income relief. These programs operate on verifying each type of income, for example, employment verified by VOI or self-employed income verified by tax data vendors. You only get relief for the income sources that have gone through the program. If you have additional sources of income not supported by these programs, your rep and warrant coverage for the loan is limited. As illustrated in the diagram below, it might be that one income that isn’t rep and warranted that can bring you down, so coverage is key.

Covered Loan Scenarios

Second, not all loan scenarios will work with these tools due to limitations of 3rd party data. For example, business returns that are not provided by the borrower, but a validated 3rd party provider. The second issue is these programs tend to use conservative calculations. As a result, if the income calculation is conservatively low, this pushes some borrowers over the DTI threshold. Many people in the mortgage business think this income is the final decision, but in fact, standard underwriting rules may result in a higher income that meets all guidelines.

Data Entry Errors

Thirdly, lenders will still be on the hook if data entry errors are made. Imagine you are using an approved program, and an error is made in the data entry. In the end, the liability for that will fall to the lender, not the agency.

While these challenges can be limiting, there is a great opportunity through seeking these rep and warrant reliefs and de-risking your operations. Having the peace of mind that you have rep and warrant relief across all incomes, such as what IncomeXpert provides, and not a fractional patchwork of coverage for elements of the loan files will help lenders sleep better at night.

Summary

At Blueprint, we frequently have clients using this three-tier approach to get more loans approved with a compliant qualifying income. Lenders use the Fannie / Freddie values where they can, utilize the higher IncomeXpert values where needed, and leverage IncomeXpert PLUS to get the relief on data entry to result in more loans through the system with full rep and warrant relief.

As you might expect, the misunderstandings of agency guidelines are as plentiful as the misunderstandings about reps and warrants. Through the 3 million loans Blueprint has processed, we looked back at the most common errors and guideline mistakes lenders made. We created this report to help lenders see if they are susceptible to these issues. If you would like a copy of this report, click the link below and we will send you a copy.