On December 27, 2020 the IRS announced a two-year exception as part of the Consolidated Appropriations Act that impacts the meals and entertainment deduction rule for businesses. This exception will be reflected on the 2021 and 2022 tax returns. How does this rule affect the way underwriting will look at self-employed borrower’s income? Let’s go over two options to help you get the right answer.

Background

The first thing we need to establish is why underwriting considers meals and entertainment an expense during the income review process. The current IRS rules state that for the most part business can only deduct 50% of what the actual money spent from meals and entertainment. When you review a Schedule C for example, if line 24b says $1,000 this would mean that the business actually spent $2,000 on this type of expense but can only deduct $1,000 from the profit / loss total. What underwriters are doing when they deduct that cash flow item is capturing the missing 50% from the profit and loss line.

Over the years many people have asked me why the underwriter subtracting meals and entertainment when it is already listed on the business taxes. Hopefully that explanation will show the “why behind the what” of that cash flow adjustment and how this is not a double dip of the same expense.

The new exception

The new exception allows the business to deduct 100% of the cost, not just 50% as stated previously. The new rule also requires businesses to document the location of their spending, that an employee was present, it was spent at a restaurant (not any kind of take out), and was not excessive. Here is a link to the IRS notice posed NOTICE 2021-25 for more information.

Options To Consider

Now we can move to your two options to handle this new change to the IRS rules. Before we get to those options, I want to stress that underwriting should NOT assume every self-employed borrower is using the new 100% rule for their 2021 taxes. As you can see above it is not a given that a business would take this route, but I assume many will to save on taxes.

Option 1: Use the 50% Deduction Rule

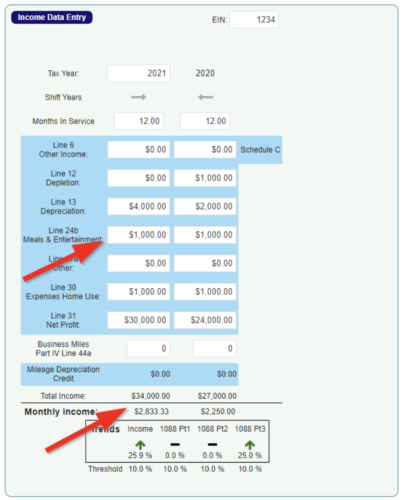

Currently income analysis worksheets such as IncomeXpert, will have you enter the amount in the meals and entertainment so they can subtract the missing portion of the expense. The worst case here is your borrower’s income is a little lower and the DTI is a little higher, but if it does not affect the approval of the loan, take this path of least resistance and has less chance of an audit.

Example

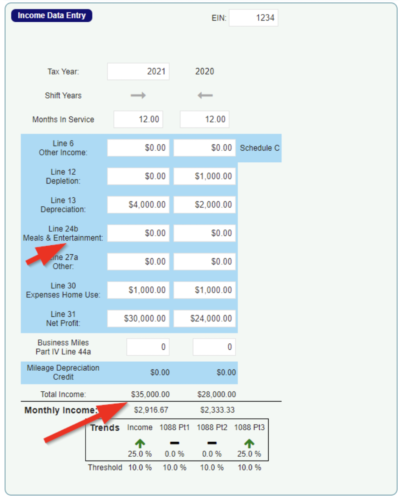

Option 2: Use the 100% Deduction Rule

If your borrower needs to have their income increased to qualify for the loan take these steps. First review 2021 or 2022 tax return to confirm you can see where the tax preparers have noted that the expenses were deducted at 100%. I would offer advice here on how to read the tax returns to find this information, but there are several ways to do it. There is no required format tax preparers must follow so it is hard to describe here. My best advice, get a letter of explanation from the person who prepared the taxes to confirm that the preparer did in fact use the 100% option.

Once you have confirmation that the meals and entertainment expense is 100% you can now enter $0 in any income worksheet because there is no need to capture the missing amount of the losses. Below I have created two examples using Blueprint’s IncomeXpert software solution to show you the differences.

Example

I hope this explanation assists you in getting your borrowers self employed income spot on. We have built IncomeXpert to make sure there are no mistakes for ANY borrower’s income. Check us out at www.getblueprint.io for information on how you can get started with IncomeXpert today!