IncomeXpert forMortgage Income Analysis

IncomeXpert is software for your whole team, allowing them to calculate a guideline-compliant mortgage income analysis every time.

Intelligent Mortgage Income Analysis & Compliance Solutions

AI-Powered Mortgage Income Analysis

Our system applies advanced AI to extract, verify, and calculate a mortgage income analysis from uploaded income documents. It provides accurate figures while adhering to agency guidelines. The analysis handles complex scenarios with clarity and consistency.

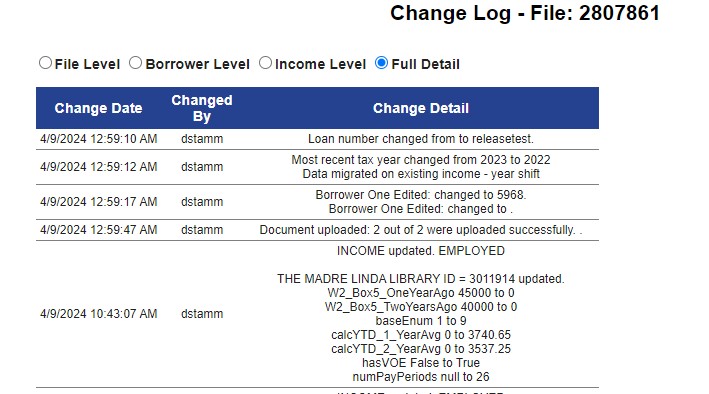

Change Log & Audit Trail

We record every modification in a comprehensive log file that tracks income adjustments. This audit trail supports compliance reviews and risk management. Detailed records offer transparency for underwriters and auditors.

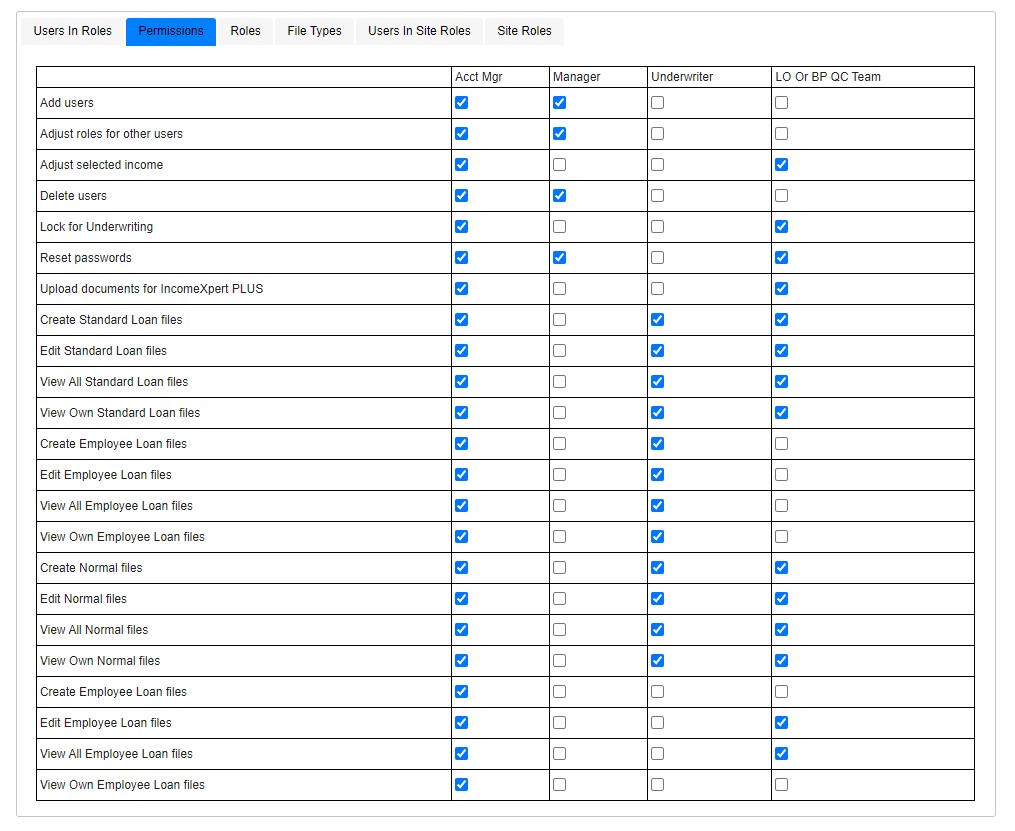

Customizable Roles

Lenders can tailor user permissions to match responsibilities. Customizable roles grant different access levels for loan officers, processors, and underwriters. This design protects data integrity and maintains compliance.

Role Management & Access Control

Our platform offers advanced controls for managing roles and access. It restricts sensitive operations to authorized personnel. The system enhances accountability and secures critical income data in a mortgage income analysis throughout the assessment process.

Who is IncomeXpert for?

IncomeXpert is best for processing and underwriting teams looking for consistency and accuracy in their mortgage income analysis. It also includes teams with complex incomes unsuitable for spreadsheet calculators.

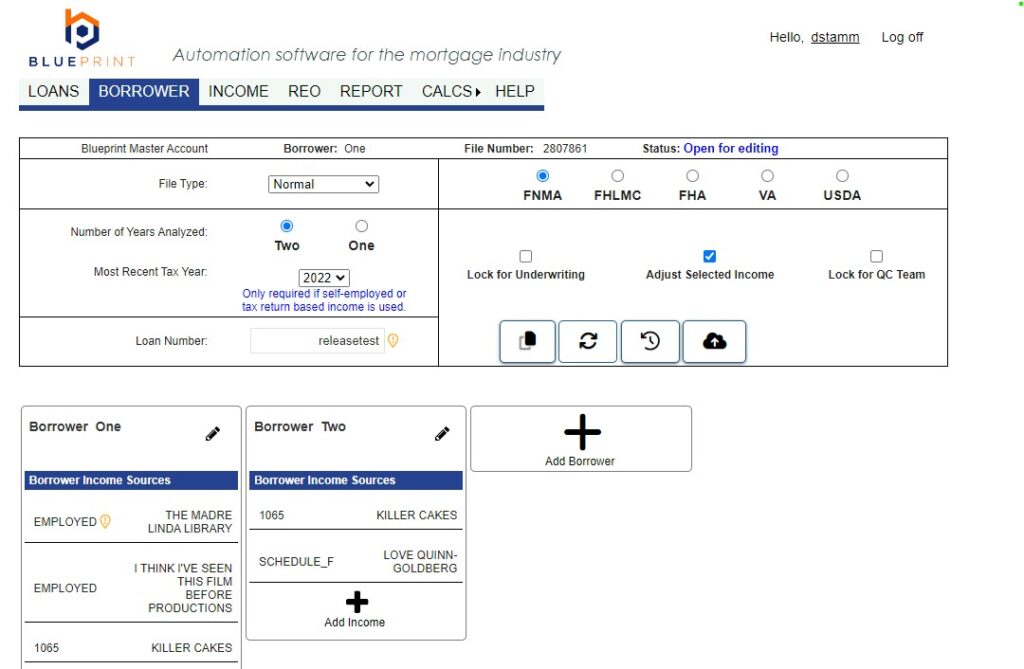

How does it work?

IncomeXpert provides an online mortgage income analysis with reps and warrants. IncomeXpert supports all FNMA, FHLMC, FHA, VA, and USDA income types.

How we ensure error free income

Ensuring error free income requires focusing many aspects of the loan, including guidelines, advisories, and tracking changes and deviations. Read on to see how IncomeXpert is able to achieve error-free income.

Guidelines

Perfect income starts with adherence to agency guidelines. IncomeXpert ingests the guidelines from FNMA, FHLMC, FHA, VA, and USDA to provide a comprehensive suite you can use to qualify more borrowers. Our team keeps up to date on guideline changes and rolls out timely updates so your team has one less thing to worry about.

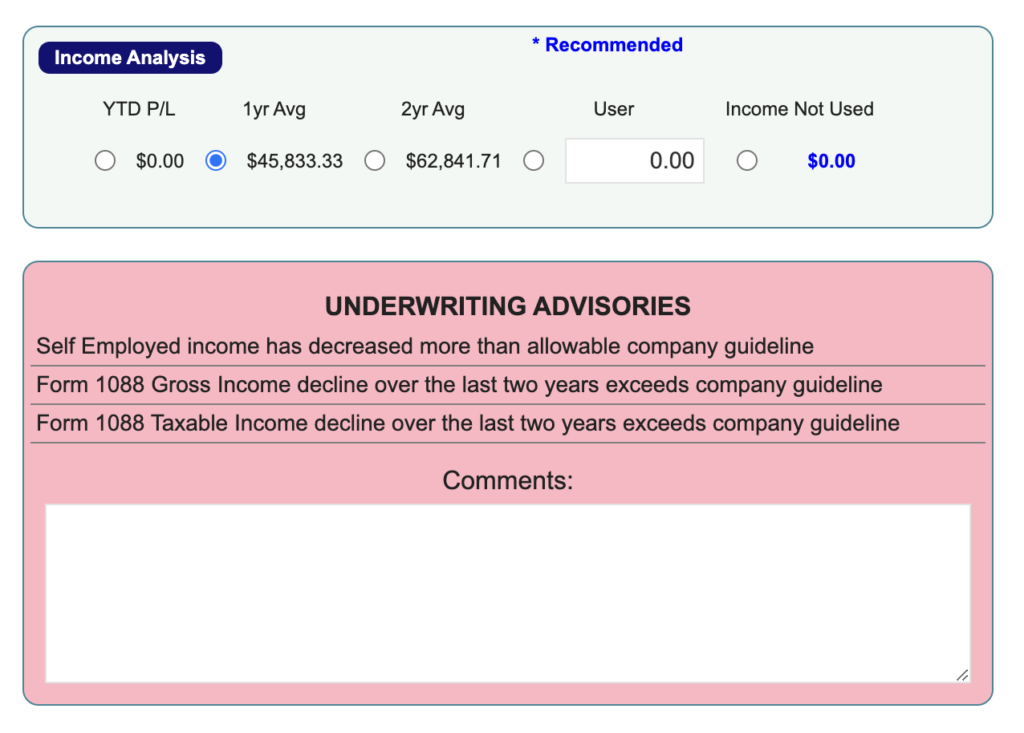

Advisories

All those guidelines can be daunting, so we provide advisories where necessary to help your team navigate the guideline. In total, we have over 200 underwriting advisories. These advisories indicate when a borrower’s income won’t qualify and meet agency guidelines, but also when further risk analysis by an underwriter may required to qualify the income.

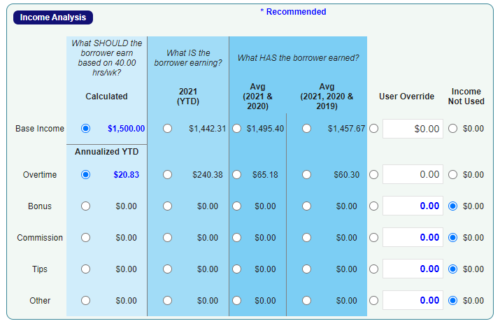

Multiple Calculations

IncomeXpert calculates all of the averages, trends, and supporting calculations to comply with agency guidelines. Many calculations are performed to arrive at our final recommendation.

Underwriters have the ability to override the recommended value if needed. The ability to override the recommendation is managed by a permission in our role manager to only allow authorized individuals to make this change..

Ready to request a demo with BluePrint today?

Identify deviations

We designate income with an icon indicating when a user has deviated from the recommended income. This allows auditors and senior underwriters to quickly focus on that particular income to understand the underwriters justification for the deviation.

Roles and Permissions

The role manager controls access and functionality between users. Functionality can be tailored across loan officers, processors, underwriting, IT, and administrative staff. Loan creation, user management, lock for underwriting, and recommended income deviation can all be controlled via role management.

Change Log

Who did what when? IncomeXpert has a complete change log history of every edit made to the loan file. This gives the utmost in visibility and transparency. Changes to add, remove, or edit borrowers, incomes, even down to the income field values are all tracked and time stamped for who made the change.

Full Reps and Warrants

Because Blueprint is so confident in our 10+ year track record and never having a repurchase demand, we can provide you full reps and warrants against calculation errors, and guideline errors.

As Seen In / As Used By

Testimonial

Ready to get started with BluePrint?

Frequently Asked Questions

Mortgage income analysis is a comprehensive process that involves calculating and evaluating a borrower’s income to support sound lending decisions. Lenders rely on tools such as a mortgage income calculation worksheet to derive accurate results. Financial institutions use Blueprint to calculate income for variable incomes and scenarios. The process complies with guidelines and uses tools such as the Fannie Mae Income Calculator and income worksheet, which offers a complete picture of a borrower’s financial capacity.

Income analysis plays a vital role in mortgage lending by clarifying borrowers’ repayment ability and reducing risk. Lenders utilize tools such as an income calculation worksheet for mortgages and the FNMA self-employed income worksheet to derive precise income figures. Blueprint presents a comprehensive approach that verifies income details across various scenarios, including self-employed and variable income situations. This process helps avoid errors that might lead to loan repurchase demands and supports a robust evaluation of the borrower’s overall financial health and stability.

Lenders verify a borrower’s income by gathering and examining various documents and data sources. They may use a mortgage income worksheet to record numbers, relying on tools like the FNMA Income Calculator , and variable income calculators to assess reported earnings. Blueprint integrates these resources to cross-check tax returns, pay stubs, VOE/VOI and W2s to calculate income. This process results in a comprehensive assessment highlighting discrepancies and confirming the borrower’s income reliability for underwriting decisions.

A complete mortgage income analysis typically requires multiple documents to thoroughly understand a borrower’s financial situation. Lenders request tax returns, pay stubs, bank statements, and additional records such as W-2 forms and profit and loss statements. We also employ tools like the FNMA Income Calculator. Blueprint accommodates these requirements by processing each document individually , which allows for a thorough analysis that supports adherence to regulatory guidelines and accurate income calculation.

Automation transforms mortgage income assessment by replacing traditional manual processes with calculated, technology-driven evaluations. Blueprint employs advanced tools such as a mortgage income calculation analysis , FNMA Income Calculator , and variable income calculator to process diverse income scenarios accurately. Blueprint addresses complex cases, including self-employed income, with a self-employed income analysis and Schedule C income calculator that automatically verifies data and highlights discrepancies. This technology-driven approach minimizes errors and delivers accurate results while maintaining compliance with industry standards, thereby enhancing the overall quality of income analysis for lending professionals.