FNMA has been busy reviewing and revamping their guidelines over the last few months. Kudos to FNMA’s Chief Credit Officer Carlos Perez and his team for continually working to improve and clarify the guidelines. That being said, don’t blink or you might miss some big changes. Over the next few weeks we will keep exploring all of the changes announced in the most recent set of SEL’s. Let’s go back a few weeks and take a look at SEL 2015-07 published on June 30th, 2015, in this announcement FNMA removed some rules that have only been in place 5-6 years as well as dropped some major rules that have been in place for decades.

Departure Residence Rule

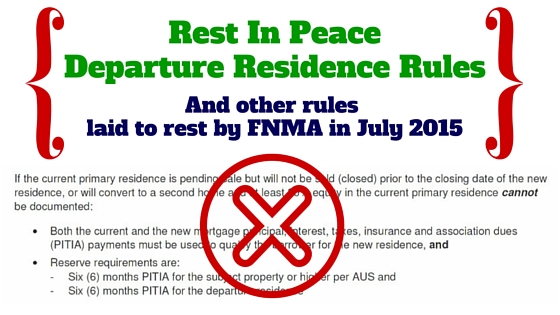

The Departure Residence Rule was put in place to slow down the “buy and bail” frenzy that seemed to be happening towards the end of 2010-2011 when the economy had recovered from the mortgage dark years (those years between 2006-2009 that we shall not mention by name). Buy and bail was the nickname for homeowners who owned their current home that had lost lots of value during that time period and made the decision to go buy a new home. In many cases where bigger, newer, and nicer but with a lower purchase price since the market had just started to recover from the crashing values. The “Bail” phase is when borrowers closed on their new home would now “try” to sell their current home but an awful high percentage would have to sell their homes “short” or “bail” out of making the payments. To combat this trend FNMA / FHLMC both put a policy (aka the Departure Residence Rule) that now required that if your current home did not have 30% equity you were required to have six months PITIA for both the new home and the departure residence. This policy did slow down this practice and made it hard for people seeking to take advantage of the market to “buy and bail” on homes. Bottom line, no more departure residence rules after June 30, 2015.

What does this mean for your borrower?

More people may be able to qualify for mortgages. Besides the benefit of less cash needed quality now, it also means FNMA allows the “old” rule of rental income on your departure residence using either the lease or the 1007 form! Here is an example of old versus new application of the Departure Residence Rule!

In this scenario the borrower is purchasing a new home and can not document 30% equity in his departure residence. They will be required to have 6 months PITIA for the departure residence and the subject property. The borrower has his departure residence ready to rent out and just signed a lease for $1,300 per month and can only show $20,000 in asset to close and for reserves.

| Prior to June 30, 2015 | After June 30, 2015 |

|---|---|

| $6,000 Income | $6,000 Income |

| $1,500 Subject Property PTII | $1,500 Subject Property PITI |

| $1,000 Installment/Revolving Debt | $1,000 Installment/Revolving Debt |

| $1,000 Departure Residence Payment | $25 Departure Residence Payment |

| DTI 58.33% | DTI 42.09% |

| ASSETS | ASSETS |

| $15,000 Closing Costs | $15,000 Closing Costs |

| $15,000 Required Reserves | $0.00 Required Reserves |

| ($10,000) Short Assets to Close | $5,000 Excess Funds Needed |

As you can see this change may seem unexciting but a few more closed loans may tip the scales from boring to exciting come commission or bonus payday! For my operations “peeps” these rules would be addressed in steps 3 and 4 of the 10 point plan for underwriting we have discussed in previous blogs.

2 Responses

How sure are you about this guideline? Any chance that this guideline has changed since the original article? We are getting pushback from lenders saying that the 1007 is only allowed fr the subject property and not the departure residence. Can you please confirm?

Thank you!

Hi Jason

I am 100% sure that the departure residency rules are no longer in effect. If your borrower has a signed lease for a tenant you can use the 75% rule on that lease without running a 1007. As far as using a 1007 to qualify rent, I agree that is NOT allowed on a departure residence, the D.R. must have an actual tenant (unlike the subject property which can be vacant!)