January Income Documentation

Happy New Year 2024 from the Blueprint Team, and welcome to our Zone Of Confusion Blog PART TWO. Posting these blogs has become a tradition for us as we go

Covers all income types and best practices for calculating and verifying borrower income accurately.

Happy New Year 2024 from the Blueprint Team, and welcome to our Zone Of Confusion Blog PART TWO. Posting these blogs has become a tradition for us as we go

Happy New Year 2024 from the Blueprint Team, and welcome to our Zone Of Confusion Blog, which has become a tradition for us to post as we go into our

Securing a mortgage for your borrower is exciting, but sometimes, you might find your borrower is on the edge of qualification. Imagine helping your borrower who is just a step

If your borrower owns rental property through a partnership or S corporation, IRS Form 8825 is one of the most important documents in the loan file. It outlines income, expenses,

As more and more people pursue a side hustle to supplement their income, one smart investment option that many people are diving into is the world of rental property. The

New Year’s is an interesting holiday to me. It is the only holiday that seems to prompt the most change in people’s lives. When you think about it, does anyone

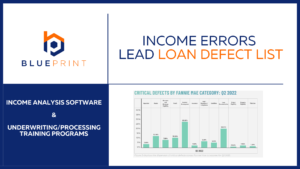

ACES reports income errors lead loan defect reasons 11th straight quarter When I write a blog headline, I try to balance the blog name between informative and relevant to give

Can you use K1 income with less than 25% ownership? K-1 income(loss) is generated from standard business structures defined by the IRS which are Partnerships using the IRS 1065 tax

One of the lessons I learned during my underwriting career is that the most likely reason a borrower defaults is due to their DTI ratio (Debt To Income), or stated

Freddie Mac Bulletin 2022-18 offers new method of income calculations for 1099 borrowers. The United States is looking at earning income much differently than it did just a decade ago.