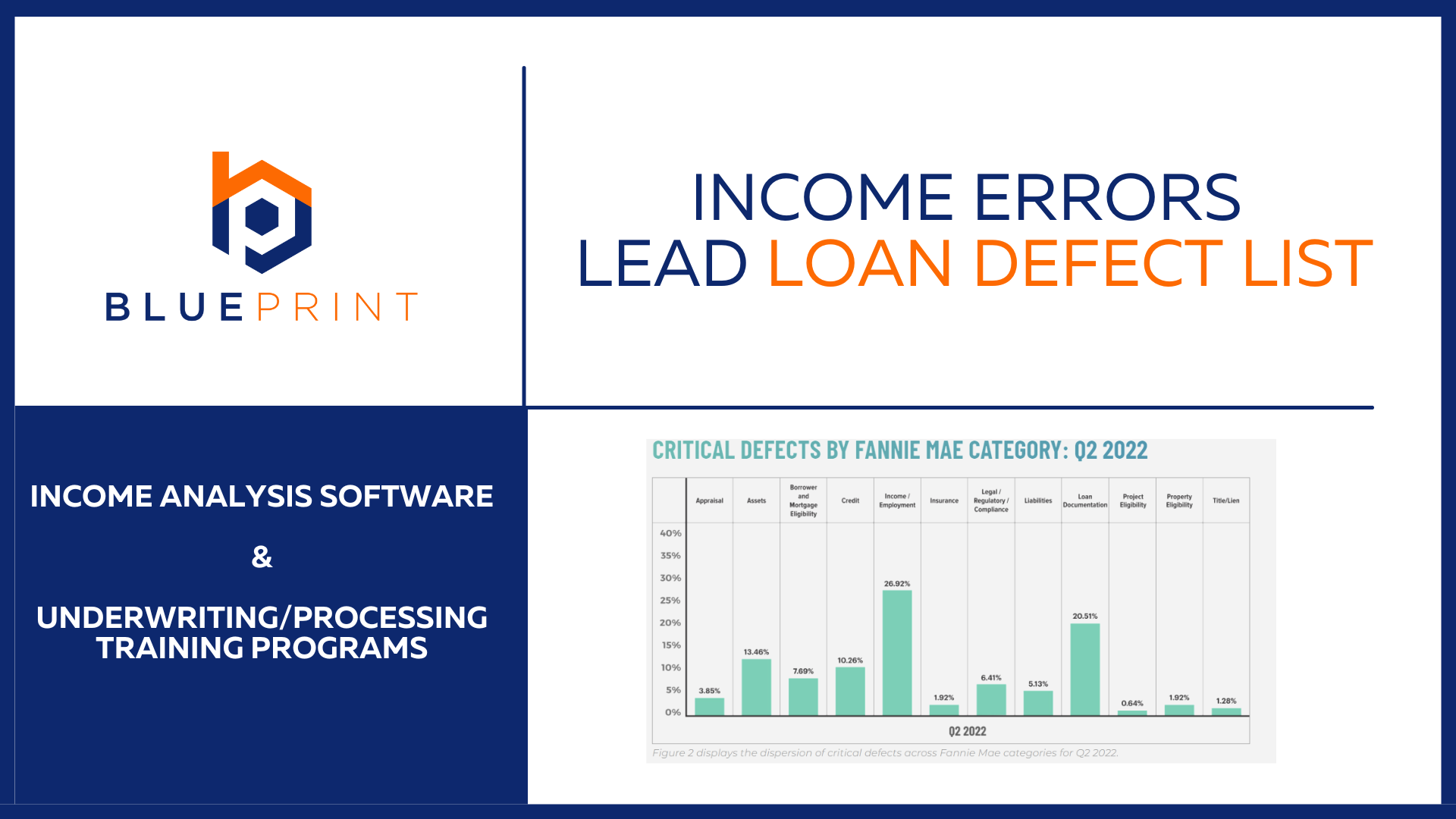

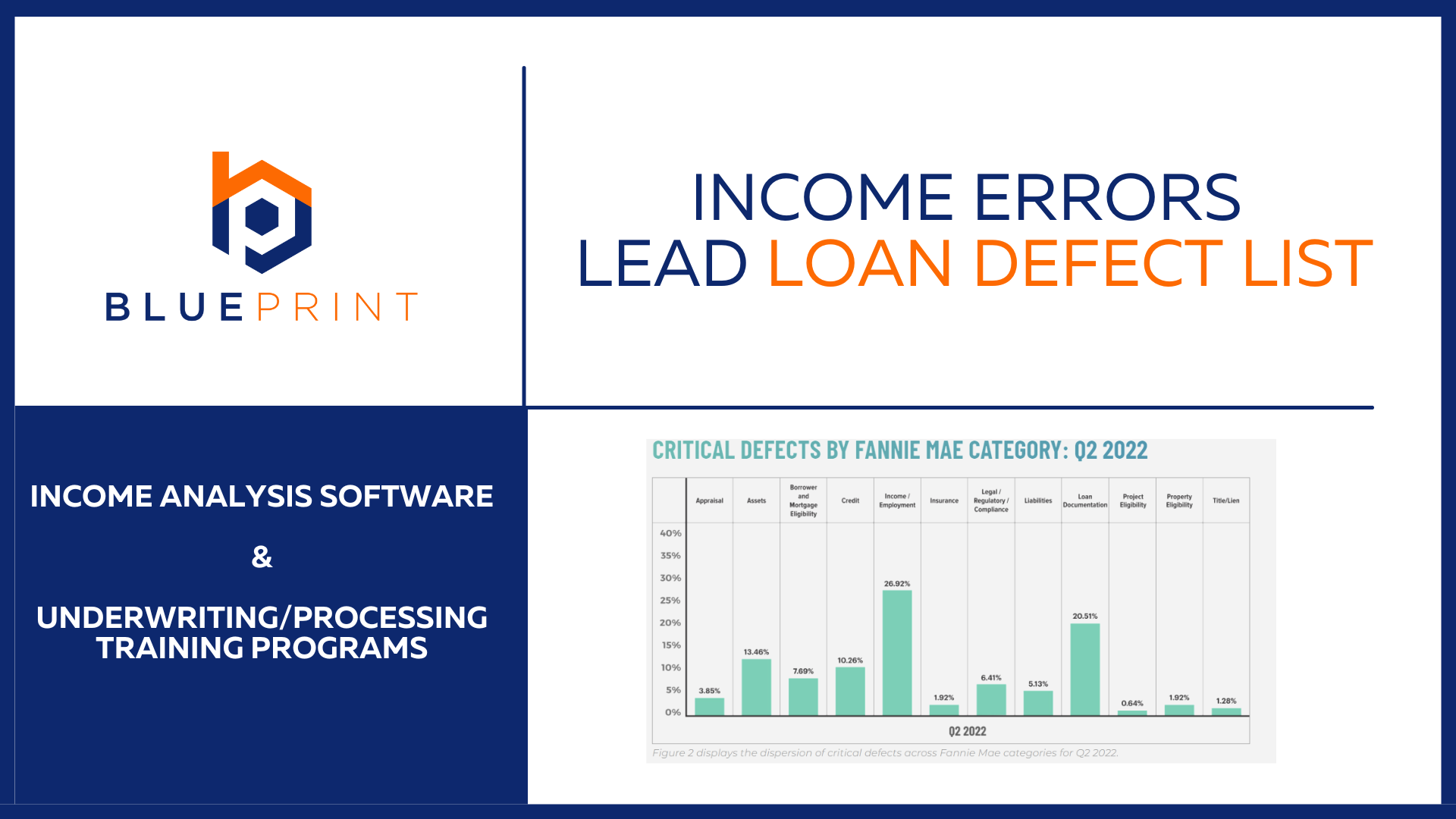

Income Defects

ACES reports income errors lead loan defect reasons 11th straight quarter When I write a blog headline, I try to balance the blog name between

ACES reports income errors lead loan defect reasons 11th straight quarter When I write a blog headline, I try to balance the blog name between

Can you use K1 income with less than 25% ownership? K-1 income(loss) is generated from standard business structures defined by the IRS which are Partnerships

One of the lessons I learned during my underwriting career is that the most likely reason a borrower defaults is due to their DTI ratio

Freddie Mac Bulletin 2022-18 offers new method of income calculations for 1099 borrowers. The United States is looking at earning income much differently than it

FHA has recently amended their guidelines to allow more flexibility to calculate income for borrowers whose variable income was affected by the COVID 19 pandemic

When completing income analysis for self employed borrowers there are a few key steps that must be followed. A liquidity test must be performed before

Calculating K-1 income for self employed K-1 income for self-employed borrowers is one of the most common questions we receive. We understand—it’s complicated. As mortgage

As a person that has worked, trained, and mentored in the mortgage underwriting world for 27 years, I definitely guessed the profit and loss situation

When January rolls around we often see encouraging messages, stories, tweets, or other social media posts encouraging us as we cross into the new year.

Working in the mortgage business means you get a little more involved in your clients life then the typical financial transaction. Speaking for myself, that

When I read LinkedIn from time to time, I have seen some funny memes on why people’s loans have died during the underwriting process. You

Let’s imagine you got lucky while you were on your vacation to Australia and won $10,000 at the Crown Melbourne Casino and want to use

We have upgraded UberWriter with some new functionality. Read on in the blog as we weave some underwriting knowledge with some product update news. One

I have been writing blogs for UberWriter since 2013 on many different underwriting topics. While putting together some training information I realized that I have

A few years back I wrote a blog explaining the rules that allow a lender to re-use the borrower’s appraisal for an additional transaction. (See the