Determine mortgage income for travel nurses

Travel nurses play a vital role in the healthcare industry by taking on temporary assignments through staffing agencies. These assignments can be local, national, or even international. Unlike traditional nurses, their income can be variable and depends on the contracts they take. For mortgage companies, determining the income of travel nurses can be challenging due […]

January Income Documentation

Happy New Year 2024 from the Blueprint Team, and welcome to our Zone Of Confusion Blog PART TWO. Posting these blogs has become a tradition for us as we go into our 11th year in business in 2024! If you have not read the fist part of this blog, “Zone of Confusion Part 1 of […]

January Zone Of Confusion

Happy New Year 2024 from the Blueprint Team, and welcome to our Zone Of Confusion Blog, which has become a tradition for us to post as we go into our 11th year in business! Why do we post this blog as a tradition? Just like in life, we have fun traditions for the holidays (i.e. […]

Future Employment Income to Qualify a Borrower?

Securing a mortgage for your borrower is exciting, but sometimes, you might find your borrower is on the edge of qualification. Imagine helping your borrower who is just a step away from obtaining that coveted mortgage approval when an unexpected opportunity arises, for instance,a new promotion or a potentially higher-paying position! This scenario opens up […]

Rental income Form 8825: Download, instructions, and filing guide

If your borrower owns rental property through a partnership or S corporation, IRS Form 8825 is one of the most important documents in the loan file. It outlines income, expenses, and depreciation related to rental real estate, directly affecting debt-to-income ratios, qualifying income, and underwriting decisions. Yet this form is often misunderstood or filled out […]

Rental income forms you need to know

As more and more people pursue a side hustle to supplement their income, one smart investment option that many people are diving into is the world of rental property. The long-term passive method of collecting monthly rent gives stable and reliable returns in today’s market – often better than random investments or flipping homes! […]

Top 3 Income Issues Slowing Your Closing | Blueprint

New Year’s is an interesting holiday to me. It is the only holiday that seems to prompt the most change in people’s lives. When you think about it, does anyone say, “This Thanksgiving I am going to start doing push-ups every day”? Some New Year’s changes occur whether you plan them or like them or […]

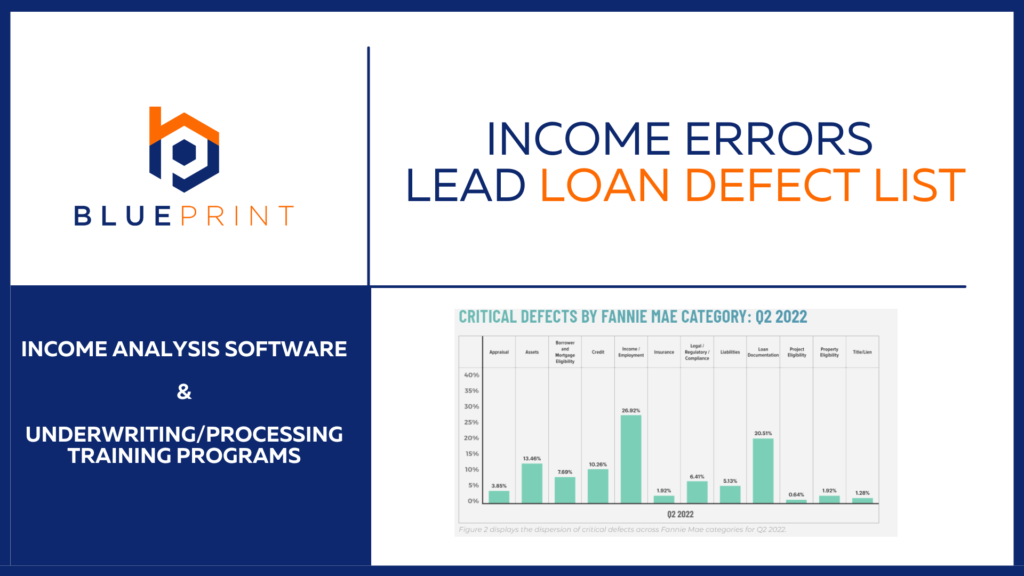

Income Defects

ACES reports income errors lead loan defect reasons 11th straight quarter When I write a blog headline, I try to balance the blog name between informative and relevant to give the reader a good idea of what the blog is about and a reason to click on it. Personally, I find too many articles today […]

Calculate Self|Employed Borrower Income | Blueprint

There are four steps on how to calculate income for self-employed borrowers. Borrowers who are self-employed have two distinct roles in the process of generating their personal income. Due to the dual nature of their daily roles of income generation and the higher risk, it can prove to be more challenging to determine their income […]

Can a borrower use K-1 income with under 25% ownership?

Can you use K1 income with less than 25% ownership? K-1 income(loss) is generated from standard business structures defined by the IRS which are Partnerships using the IRS 1065 tax form and the S Corp using the IRS 1120S tax form . These entities both use an IRS form K-1 as one of the ways […]