Common oversight on loans secured by assets

Have you ever completed a process at work over and over, so much so that you don’t even think of the action when you are doing it? For example, your brain goes on autopilot when punching in, then your autopilot turns to get some coffee in the break room. Next thing you know you are […]

SEL 2015-10 Eases Restrictions on Non-Occupant Co-Borrowers

Both of the GSE’s continue to review and revamp their guidelines on a number of topics, today’s blog we will go over the changes that now make it easier for a non-occupant co-borrower to help out your borrower with Fannie. In the past when you had to use a non-occupant co-borrower (going forward lets call […]

Freddie opens up more room for investment properties

Over the last few weeks we have been talking about some big changes in the guidelines over at Fannie Mae, but Freddie Mac is also in the process of making some big changes to get more business. There are a pair of changes when put together are going to open up some new opportunities for […]

FNMA SEL 2015-07 Makes A Dollar Worth A Dollar

Last week we began to go over the multiple changes to the underwriting guidelines announced in the last few months of SEL’s published by FNMA. The change in the way FNMA now looks at assets will be a change that will impact most every file since assets are such a common and key piece of […]

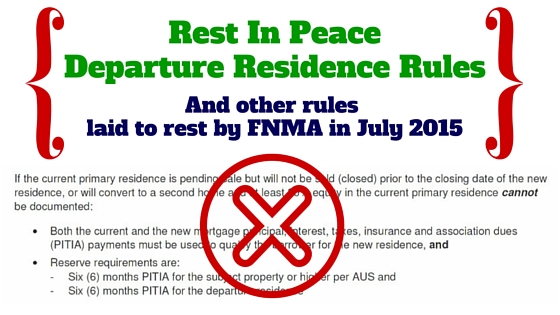

Departure of FNMA Departure Residence Rule SEL 2015-07

FNMA has been busy reviewing and revamping their guidelines over the last few months. Kudos to FNMA’s Chief Credit Officer Carlos Perez and his team for continually working to improve and clarify the guidelines. That being said, don’t blink or you might miss some big changes. Over the next few weeks we will keep exploring […]

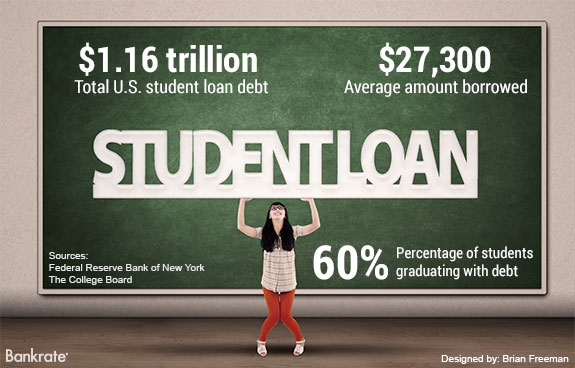

Time to re-read that FNMA student loan payment section

A few weeks back I was working on a purchase loan that was submitted to underwriting for review, nothing out of the ordinary at first, the borrowers had great credit, long term jobs, and a solid down payment. After review of the loan the borrower had one issue with a DTI that was over (48%) […]

FNMA guidelines on interest and dividend income

This installment of the Underwriting guy video blog is Interest / Dividends / Capital Gains. Today we will review the following What the guidelines from FNMA on using interest /dividend/capital gains What documents are needed to support these income types How do you calculate income from these sources Learning how to properly add in these […]

Multiple Financed Properties – what does and does not count?

Video Overview – Multiple Financed Properties The FNMA Multi Property Loan can be intimidating if you have not yet had to originate or underwrite a borrower who is a little more complex than your first time investment property purchaser. The first thing you have to understand is how many properties that FNMA and FHLMC will […]

UberWriter Has Launched

UberWriter is exiting beta and launching on March 2, 2015. Thanks to all of our beta users in helping refine and improve the site. In this video Michael reviews the history of how UberWriter started and what it has grown into over the last 2 years.

New FNMA change is declining more borrowers

Video Overview – FNMA SEL-2014-16 Have you looked at the new FNMA SEL-2014-16 posted in December of 2014? If you work with self employed borrowers who own a partnership (1065 tax form) or S Corp (1120S tax form) you need to know the details of this announcement. Borrowers who would have been approved weeks ago […]