This time of the year we all have an important to-do list item…. tax preparation. I try to make sure I turn in my numbers to my CPA by my birthday February. Now that I have a chance to look through the tax returns to complete my own tax preparation, I wanted to report what I have found that is new for the 2021 return. This will point out items that may affect how lenders look at personal tax returns.

One spoiler alert, at the bottom of the blog I will have a link that you can watch part one of my four part webinar series on calculating self employed borrower income. On that webinar I go over a proven sequence of steps to go review the tax returns and what documentation is required to calculate taxes according to agency rules.

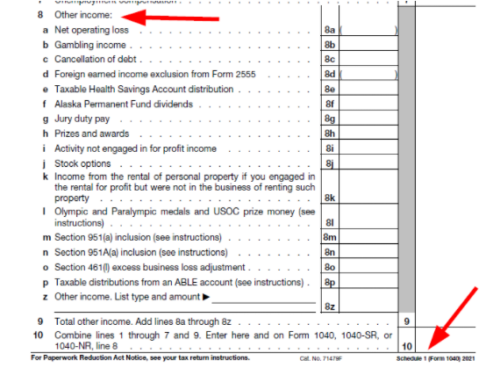

Schedule 1 Other Income List

On the Schedule 1 form the IRS has broken out Other Income from a single line (formerly 1040 Schedule Line 8) to seventeen lines. On the plus side this makes it easier to see the income type and check the agency guidelines to see if that income type can be used.

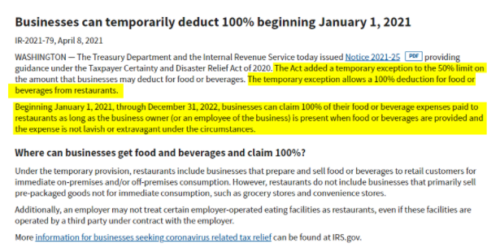

Meals & Entertainment Deduction Changes

Previously, the IRS allowed you to write off some of the money spent on meals and entertainment. We are all familiar with the requirement to subtract the missing 50% of the actual meal and entertainment expenses from our calculations. The IRS has updated their guidelines and stated that for 2021, businesses can temporarily allow 100% deduction for restaurant food. This is no doubt a reaction to the changes of life due to COVID and offices going remote and shut down.

My advice on how to handle this is to still deduct what you see in the Sch C/F , 1065, 1120S, and 1120 returns on the meals and entertainment lines. This will make sure you don’t assume that the meals were in fact all at restaurants and following IRS rules.

The good news: I don’t see any other changes that would affect income calculations from the mortgage underwriting stand point.

[/fusion_text][fusion_separator style_type=”single solid” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” flex_grow=”0″ top_margin=”20px” bottom_margin=”20px” width=”80%” alignment=”center” border_size=”” sep_color=”” icon=”” icon_size=”” icon_color=”” icon_circle=”” icon_circle_color=”” /][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” content_alignment_medium=”” content_alignment_small=”” content_alignment=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” font_size=”” fusion_font_family_text_font=”” fusion_font_variant_text_font=”” line_height=”” letter_spacing=”” text_color=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Reading Tax Returns

As promised, here is a link to a popular training webinar I offer. This is part one of a four part series exploring tax returns and self-employed borrowers income. The video linked here goes over the proven step by step method of reading tax returns and getting the most income for your borrower to qualify.

Got Suggestions?

We do our best to bring you informative content that cover the “What, Why, and How” of the mortgage underwriting process. If you have a topic that you would like covered, send us an email

2 Responses

Nicely done Mike!

This was so basic and fantastic. Covers some of the areas where I considered “gray areas” on what to calculate. Example: percentage of ownership and following the Schedule C to the broken down K1 or 1120s