Mortgage Process Automationwith IncomeXpert

IncomeXpert PLUS scans income and tax documents to automate income analysis and eliminate human data entry.

Automate to eliminate human error

Upload Tax Returns

Free your team from wasted time on manual data entry and the risk of human errors and typos.

Hybrid Automation

Use IncomeXpert manually or upload and automate the income analysis where you need a boost. No rigid all-or-nothing plans here.

Full Quality Control Review

All automation files have a full domestic Quality Control review before being released to the client.

All Employed And Self-Employed Income

Single source of truth for all income analysis. Tax forms, W2, Paystubs, VOE, VOI, Profit and Loss.

Ready to request a demo with BluePrint today?

Income Types Supported

Employed (W2)

Employed (Paystub)

Employed (VOE / VOI)

Rental Income

Schedule 1

Schedule C

Schedule E

Schedule F

1065 & K1

1120

1120S & K1

Workflow

You upload the documents, we scan them and determine what income is present and who it belongs to. We extract the data and set up income calculators for you automatically.

01

Create

Create a loan and add the borrowers. This tells IncomeXpert which borrowers to target during the scan.

02

Upload / Scan

Upload tax returns, W2, VOE, or VOI to start the automated income analysis process.

03

Quality Control

IncomeXpert notifies you that the scan and QC checks are finished.

04

Report

IncomeXpert notifies you QC is complete and you can review your full income report.

What about data entry errors?

We have you covered with IncomeXpert. A data entry error can ruin correct arithmetic and guideline compliance. We can remove the human error from data entry and provide full reps and warrants against data entry errors by using IncomeXpert.

IncomeXpert allows your team to upload tax returns, VOE, paystubs and other income documentation and our software will scan and extract the data from the form. Many companies can do this, scanning and extracting data is nothing new to the mortgage industry. Blueprint has refined this technology and gave it a smart workflow to ensure you get quality data.

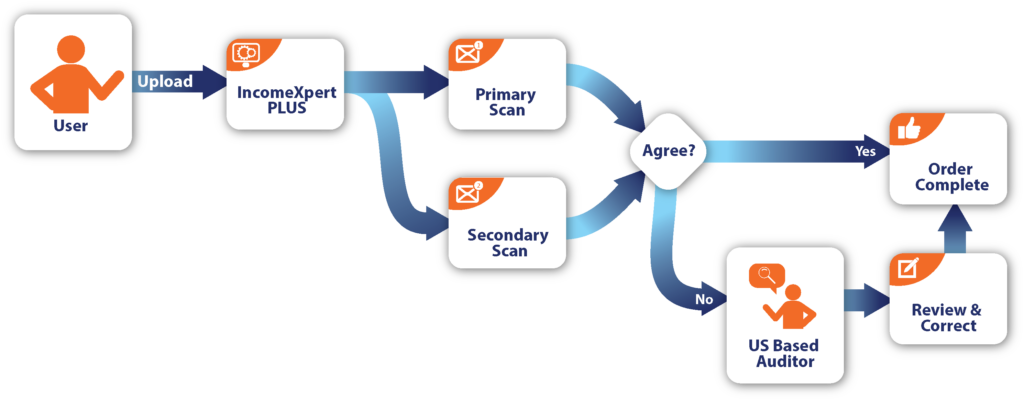

OCR Isn’t Perfect

Scanning technology is not perfect. Everyone knows this, so how can we reliably use it? Blueprint created two independent scanning solutions using diverse technologies. We scan and extract each page twice. When we get a disagreement between the two, it is routed to a US-based human auditor to correct any discrepancy.

The end result is you get assurance and full reps and warrants that the income data is entered correctly. For a full list of income types and document types that we support, please consult this article.

A Complete Income System

IncomeXpert gives your team complete coverage for all income types across the five major agencies, combined with full reps and warrants against income calculation errors, as well as data entry errors. IncomeXpert is a one stop shop for your entire mortgage automation operation.

FNMA Income Calculator

Users of the IncomeXpert automation can also leverage FNMA Income Calculator to their income analysis. Learn More.

Buyers Guide to Automated Income Analysis

Are you looking to setup an automated income analysis system at your company? If you are looking to build your own, or consider a vendor such as Blueprint, we have a resource for you to help. We created a checklist to guide any implementation. Click the link below to get the report.

As Seen In / As Used By

Testimonial

Frequently Asked Questions

Mortgage process automation refers to utilizing technology and software solutions to manage routine tasks throughout the mortgage industry. This methodology replaces manual input with automated mortgage processing systems that execute calculations, validate data, and monitor compliance measures. Mortgage automation software empowers lenders in implementing mortgage loan automation while minimizing dependence on outdated manual methods. By integrating mortgage automation technologies, teams achieve enhanced data clarity, reduced errors, and adherence to strict guidelines. The outcome is a dependable process supporting accelerated decision-making and strengthened risk management. GetBluePrint.io delivers a mortgage automation platform designed to handle these critical tasks with precision and confidence.

Automation in mortgage processing deploys intelligent systems to transition from manual methods toward automated mortgage processing workflows. Lenders gain advantages from tools managing repetitive calculations and data analysis through mortgage automation technologies. The approach supports mortgage workflow automation that minimizes mistakes while identifying areas demanding additional attention. Organizations implement mortgage automation services to transform traditional processes into well-defined, efficient procedures that bolster operational confidence. This methodology enables professionals to concentrate on strategic decision-making rather than manual tasks. GetBluePrint.io provides a solution managing complex calculations and strict compliance with agency guidelines, allowing you to make informed decisions efficiently.

Mortgage automation plays a vital role in minimizing underwriting errors by automating the evaluation of income and risk factors. Mortgage automation software assumes responsibility for tasks conventionally handled through manual data entry, substantially reducing human error potential. Through automated mortgage processing, data undergoes analysis according to established guidelines, highlighting discrepancies at early stages. Mortgage loan automation employs a robust system detecting and documenting adjustments to provide underwriters with transparent modification trails. This data transparency reduces calculation mistakes and facilitates more comprehensive review processes. Blueprint’s platform utilizes advanced mortgage automation technologies integrating real-time alerts and role-based permissions to sustain rigorous oversight throughout underwriting operations.

Mortgage process automation does not eliminate underwriter roles. Rather, it equips underwriting teams with powerful mortgage automation software managing routine calculations and data verification tasks. Automated mortgage processing delivers dependable data, enabling underwriters to focus on risk evaluation and strategic decisions. Mortgage automation services establish a system documenting every action while permitting underwriters to review and authorize calculations confidently. The technology furnishes clear audit trails and supplementary guidance without diminishing the underwriter’s professional judgment. Blueprint’s solution operates alongside your team, offering a mortgage automation platform that enhances precision and supports informed decision-making while preserving the underwriter’s essential role.

Mortgage automation transforms borrower experience by advancing accuracy and transparency throughout the loan approval process. Automated mortgage processing enables lenders to deliver a mortgage loan automation system reducing delays stemming from manual errors. Borrowers receive expedited application updates as mortgage automation technologies process income data reliably. Mortgage workflow automation establishes a system recording every step, providing clarity and accountability from application through closing. This process delivers a more structured experience for borrowers, featuring improved communication and diminished uncertainty. Blueprint leverages a mortgage automation platform supporting accurate assessments, resulting in smoother, more predictable experiences for every customer