After years of working in underwriting when you look through enough loans it becomes easier over time to recognize a borrower’s income type. However there are those income types that are rare and when you run across them can take you out of your underwriting rhythm. One of those income types is the statutory employee. They stand out because their pay stubs will have the normal SSA, Medicare, and health insurance deductions, but have no deductions for federal, state, or local taxes removed and they will generally have filed Schedule C tax forms.

A first glance you might think these borrowers are self-employed because you will see their w-2 income transferred to a Schedule C. Their schedule C will look pretty much identical to any other sole proprietor or independent contractor. But don’t fall into this trap, they are in fact employees and will require all the same documentation an employed borrower does (pay stubs, verbal VOE, and W-2).

What is a statutory employee

Wikipedia gives a really good underwriting overview of this employment type:

A statutory employee is an independent contractor under IRS common law that is treated as an employee, by statute, for tax withholdings. For a standard independent contractor, an employer cannot withhold taxes, as this would change the independent contractor relationship into an employer-employee relationship. Statutory employees are also permitted to deduct work-related expenses on Schedule C instead of Schedule A in the United States tax system. As a result, they are allowed a greater tax deduction for business expenses than standard employees, as Schedule C expenses are not subject to the 2% adjusted gross income threshold as seen with Schedule A.

Examples of borrowers who will be statutory employees

- A life insurance agent whose main business is life insurance and annuity for one company

- Someone who works from home on materials an employer supplies, that must be returned and for which the employer gives work specifications

- A traveling salesperson who turns in orders from wholesalers, retailers, contractors, hotels, or restaurants, either for resale or business use. Work performed must be the principal business activity of the employee

- A driver distributing non-dairy beverages, meat, vegetable, fruit, or baked goods; or who picks up laundry, if he acts as an agent or is paid by commission.

How to calculate income for the statutory employee

The good news here is that working with a statutory employee requires almost all of the same items as working with a commissioned borrower. Here is the step by step to get the correct income.

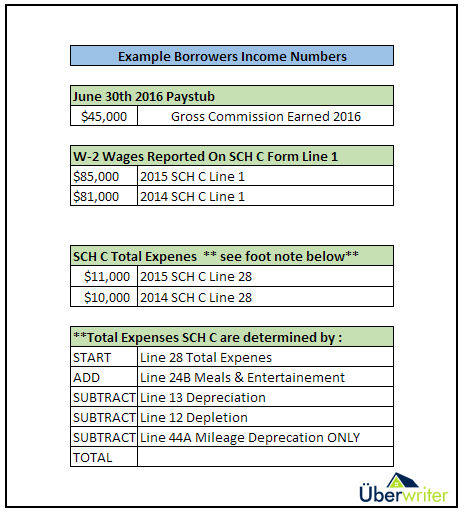

Step 1: Determine the amount of expenses to deduct

Calculate the expenses that must be deducted from the income. These are found on the Schedule C versus the Schedule A that most commissioned borrowers have.

- Start with Line 28

- Subtract Line 12 depletion

- Subtract Line 13 depreciation

- Subtract Line 27a ONLY if you find one-time expenses, amortization, or causality loss listed on page 2

- Add Line 24B Meals & Entertainment

- Subtract Line 44a mileage depreciation only

- Equals Total of expenses

SCH C Example

Step 2 analyze the gross trending income

Calculate the average monthly income is per year to confirm stable income trend.

- Take YTD gross sales divided by number of months elapsed in year to get monthly income

- Take 2015 W2 income divided by 12 (NOTE these borrowers may have more than one W-2 source)

- Take 2015 W2 income divided by 12

Once you have this trending income confirmed as stable, determine what length of time to average, for example YTD only, or YTD + 1yr, or YTD + 2yr.

Step 3 Determine the final income

There are two prevailing thoughts on how to determine the final income, I will show you both, method two is the more conservative method, but both will give you a properly qualified income analysis.

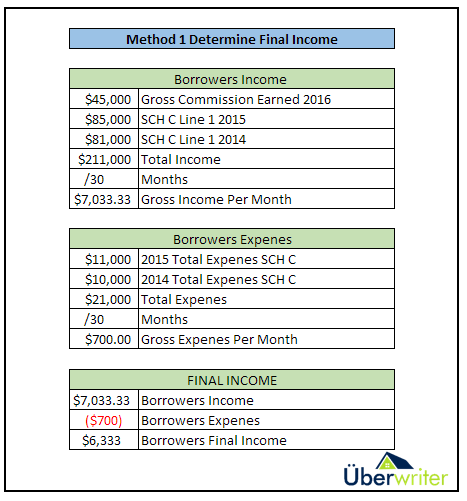

Method 1

1) Add up year to date commissions + From 2015 W-2 SCH C Line 1 + 2014 W-2 From SCH C Line 1

2) Subtract 2015 and 2014 Total Expenses found on Schedule C

3) Arrive at total income

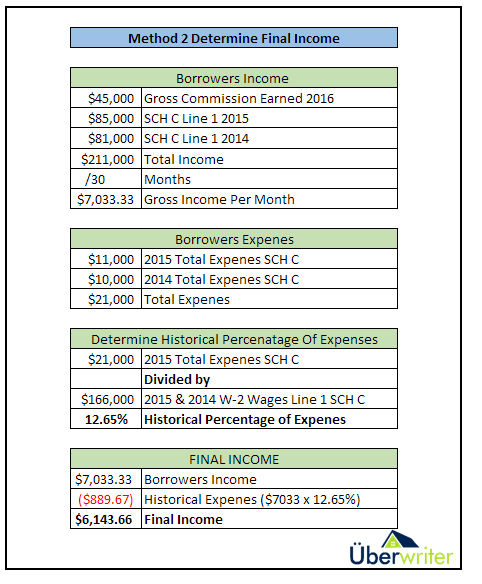

Method 2 (more conservative method)

1) Add up year to date commissions + From 2015 W-2 SCH C Line 1 + 2014 W-2 From SCH C Line 1

2) Determine the historical percentage of expense the borrower has deducted in previous 2 years

3) Subtract the historical percentage of expense from the total income

4) Arrive at total income

7 Responses

Is this accepted by FNMA, FHLMC, FHA and VA? I know our comany’s policy is to treat as schedule c (I.e. Like an independent contract). We would. Still review the W2s and pay stubs to verify the income is in line and stable.

Hi Leslie

Thank you for the comment! In my career I have seen companies do this both ways, first treating them like any other SCH C independent contractor, and second using the methods I have described. In my research I have not found any direct guidance on how to handle these borrowers outside as my time as an auditor, and the agency allow for flexibility on this. This is why I put the information in the blog to show the reasoning behind the income method.

If you attend a FHLMC income webinar you will find that FHLMC wants all independent contractors marked as “employed” and there income registered as commission. There stance is if you are a 1099 contractor (for example you sell Snap- On tools) you are not the owner of snap on you are simply sales person for the product. They still want you to use standard SCH C calculations but enter it in under commission and explain your numbers on the 1008 and why there is no paystubs in the file. This explanation of FHLMC 1099 income is the basis for treating a statutory employee as I have described, since these borrower generally get their income from one source, you can more closely follow commission income thought process than you can with an independent contractor.

Hope that helps BUT I always tell people to follow your company guidelines and procedures for income review.

Excellent explanation

Where we have a low risk file but very variable income – 15 ( high/average) 16 (low – low) 17 abnormally high ( with an AMT filed and extension) 18 YTD on track for 15’s numbers …. Can we feasibly use your 2nd Method ( the more conservative ) with an average of 15 and 16 and YTD on 18 – Omit 17 altogether as mathematically it does’t belong . Would this be allowed or would the rules regarding decrease income apply – It’s a mathematic conundrum as 16 is lower than 15 , 17 is higher than 15 and 16 and 18YTD is looking like 15 , If the rules of “declining income” apply then we are stuck. The loophole then would be the Classification as an employee and the fact that the borrower already paid their AMT for 17 which was actually double the gross income for the Low year ..If we can use the base with the extension / knowing that the min income has already been established then we are good to go . Your thoughts ?

Hi Rachel

When a borrower files an extension that pretty much takes the year out of the mix so the years you need to evaluate is 2016/2015. I would not submit or look at 2017 until they have been filed, but this does create an issue which is the low year in 2016. My best suggestion is to tell the borrower he/she needs to file 2017 returns that way you can use 2016/2017 in a 24 month average. As to your question about “skipping” years and using 2018 YTD income, that is not possible, the one thing you can do is Freddie Mac does allow audited P/Ls to be used for income …but it would be cheaper and faster to have the borrower file 2017 returns. Hope that helps!

Why are you looking at his tax return if he’s considered employed?

Hi Joel

Quoting the blog…

What is a statutory employee

Wikipedia gives a really good underwriting overview of this employment type:

A statutory employee is an independent contractor under IRS common law that is treated as an employee, by statute, for tax withholdings. For a standard independent contractor, an employer cannot withhold taxes, as this would change the independent contractor relationship into an employer-employee relationship. Statutory employees are also permitted to deduct work-related expenses on Schedule C instead of Schedule A in the United States tax system. As a result, they are allowed a greater tax deduction for business expenses than standard employees, as Schedule C expenses are not subject to the 2% adjusted gross income threshold as seen with Schedule A.

Hope that helps!