FNMA large deposit rule on refinancing

A few days ago I received a question about how to handle large deposits when the transaction is a refinance on a FNMA conventional loan.

A few days ago I received a question about how to handle large deposits when the transaction is a refinance on a FNMA conventional loan.

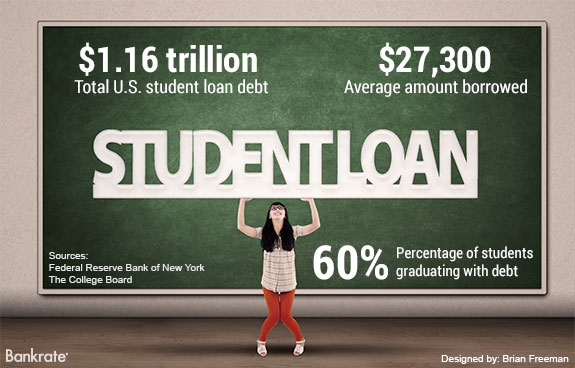

As a parent with two kids attending college the discussion of getting through college with minimal student debt (or none at all) has been a

Sometimes when competing for a new loan, your running “neck and neck” on the offered interest rate and need to find little edge to win

During 2015 FNMA had notified users in a few of the SEL’s about guideline clarifications on self employed borrowers that felt a bit like a seesaw.

Both of the GSE’s continue to review and revamp their guidelines on a number of topics, today’s blog we will go over the changes that

Over the last few weeks we have been talking about some big changes in the guidelines over at Fannie Mae, but Freddie Mac is also

A few weeks back I was working on a purchase loan that was submitted to underwriting for review, nothing out of the ordinary at first,

Video Overview – Multiple Financed Properties The FNMA Multi Property Loan can be intimidating if you have not yet had to originate or underwrite a

For the last installment we are going to look at the 1120S and 1120 corporation returns inside the lens of the cash flow analysis form.

Self employed income analysis… probably one of the harder things to get your mind around if you work on the mortgage industry. However once you

It seems over the last few years FNMA and FHLMC are moving just a little further apart in how they look at lending. In my

Updated 07/15/2018 to correct All Regs References For Freddie Mac One thing about the mortgage business you can count on is change, but not everything

Regulation Change Update: The following blog was posted in January of 2013 and the regulations have changed since we posted. Question: When reviewing business tax