Full QC on every loanEvery automation file is fully QC’d for accuracy

Hybrid automationManual vs. upload is your choice.

Upload tax returnsAutomate your workflows

Previous

Next

What is the right income for my borrower?

A trending analysis will tell you!

Income Trending Analysis is the missing concept that often holds back teams form having a uniform process which minimizes risk for income determination. All agencies require trending analysis, but Fannie Mae does the best job explaining what is expected and their explanation is found in FNMA Guidelines B3-3.1-01.

Why do I have to do an income trending analysis?

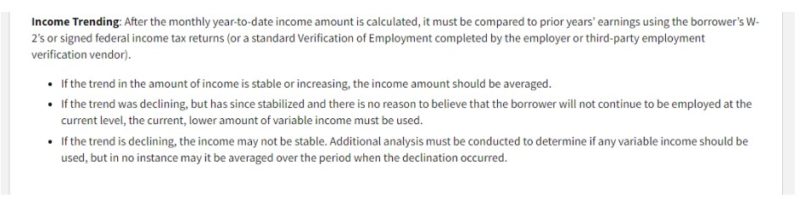

All agencies, Fannie / Freddie / FHA / VA / USDA require it! Here is what Fannie Mae says in a nutshell

- If income is stable OR increasing the income should be averaged

- If the income was declining but now stable the current lower amount MUST be used

- If the income is declining, it may not be stable. Additional analysis must be conducted to verify if the income can be used. BUT in NO instance may it be averaged over the period of declination.

Fannie Mae is not saying, “if you feel like it, or when you have time”… it says MUST.

The next question is how much analysis do you need? Agencies require the underwriter to approve an income that is most likely to continue. They are not asking for the worst case or most conservative income. The agencies are not looking for the most optimistic income to approve the loan either. So how do you find balance?

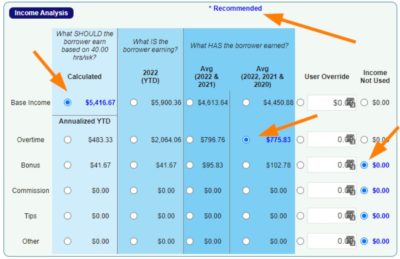

Before this begins to seems overwhelming we have a solution! IncomeXpert helps our clients get the income right EVERYTIME. In IncomeXpert the all of the trending analysis is done for you. The recommended income is based on the comprehensive trending analysis. Additionally, supporting calculations show how the income was determine and why the income was selected based on the income trend.

How do you do trending analysis?

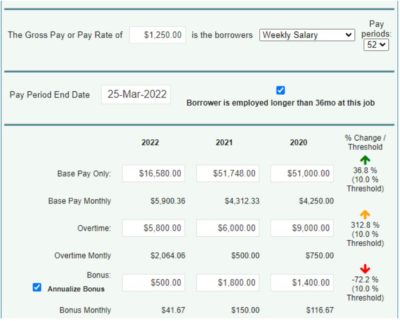

Income Trending Analysis needs to consider the borrowers income from three perspectives.

What should you earn?

Calculating the hourly wage/salary to determine full-time income

What are you earning?

Calculating the year to date income to compare to calculated and past income

What have you earned?

Calculating the past year(s) income to support a trend

When the raw calculations are done, a trending analysis is performed to show income stability. The trending analysis considers the year over year percent change to show if between to adjacent years the income increased or decreased. Armed with all of the year over year percent changes we can determine the income value that will most likely continue per the agency guidelines.

With this thought process IncomeXpert now goes into phase two and checks the required income trend and analyzes the stability of income. Once it completes that review, the service will then recommend a final income number using best practices from decades of underwriting experience.

Keep in mind the income trend must be calculated for each component of the borrower’s income. That means you repeat the calculations for base, overtime, commission, bonus, tips, and other. While there is quite a bit of math involved in doing a trending analysis, none of it particularly difficult. But many underwriters aren’t looking at this level of detail to see the underlying trends for each component of the income.

Furthermore as an underwriter you need to be able to show your work and support how the income was determined. Enter the need for a systematic solution such as IncomeXpert that does all of this analysis for you and provides you the recommended income per agency guidelines.

Conclusion

Income Trending analysis is required by the guidelines and is the systematic way to get stable and predictable income. The guidelines actually are helping lenders analyze income but the need for a tool to help the underwriter conduct all of the income analysis correctly and efficiently is often what is missing.

Furthermore organizations can begin to apply their own risk controls on these trending analysis by defining what thresholds would result in the income being used, or non used. If the way the income is analyzed is consistently calculated, now the organization needs to asses what is the year on year percent change that constitutes acceptable risk for their portfolio.

Total Income System – IncomeXpert

If you are struggling with income, guideline compliance, and getting consistent income. IncomeXpert might be a solution to consider. We provide over 200 guideline checks, trending analysis, and a complete income analysis system for your organization.

SCHEDULE A DEMO